- Summary:

- A 400% jump in foreign investment inflows in August has boosted the value of the Nifty 50 index, sending it to 4-month highs.

Indian shares have ended the trading day on a high, with the Nifty 50 index touching off the 17965 price mark for the first time since early April after a gain in consumer stocks propped the index. The Nifty 50 index closed the session 0.67% in green territory, making it the third straight winning session this week.

Stocks on the Nifty 50 index have been on a recovery move following the 17 June bounce off the 15183 price mark. Since touching off those lows in the past two months, the index has gained more than 13% as foreign portfolio inflows improve.

Foreign portfolio investments (FPIs) are responsible for about $2.83 billion in share purchases on the Indian bourses in the first two weeks of August 2022. This exceeds the total of $618 million in share investments seen in July, representing a more than 400% jump in FPIs.

Signs of cooling inflation have tapered expectations of more aggressive rate hikes by the Reserve Bank of India. Moreover, strong earnings numbers by listed companies in the June quarter are also spurring demand that has sent the Nifty 50 index northward. More than half of corporate results reported so far have beaten analysts’ expectations. Recent moves by consumer and auto stocks are behind this week’s gains on the Nifty 50 index.

Nifty 50 Index Forecast

A look at the weekly chart (not shown) indicates that the price action from the 23 March 2020 pandemic low has formed a bullish flag, and the recent uptick on the Nifty 50 index is a resolution of this flag to the upside.

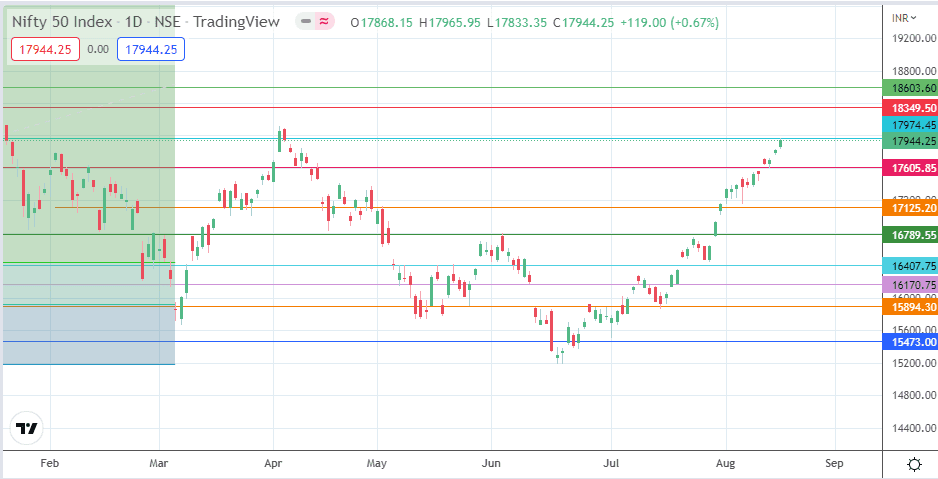

This opens the door for the potential of hitting new record highs if the bulls can take out the current resistance at 17974, the subsequent upside barriers at 18349, and the current all-time high at 18604. This creates the potential for hitting new record targets at 19814 and 21339, which are the 27% and 61.8% Fibonacci extension levels from the swing low of 19 April 2021 to the swing high of 18 October 2021.

On the flip side, a correction from the present resistance high targets 17605 initially (8 April and 12 August lows) before the 17125 (4 May high) and 16789 (3 June high) price marks enter the mix as additional downside targets following a deeper correction.

Nifty 50: Daily Chart