- Summary:

- The USDCAD pair could be the subject of yet another fundamentally-driven divergence trade opportunity, as the NFP comes up tomorrow.

It is the first Friday of the new month, and this brings the first Non-Farm Payrolls for the year and the Canadian Employment data. These two employment data sets will be released at the same time on Friday, January 8, thus providing a divergence trade opportunity for the USDCAD as far as fundamentals are concerned.

The US expects to add 68K jobs (previous 245K), with an unemployment rate of 6.8% (previous number; 6.7%). Canada expects to lose 29.5K jobs (previous number; 62.1K), with unemployment expected to rise from 8.5% to 8.7%.

Trading the News: Key Levels to Watch

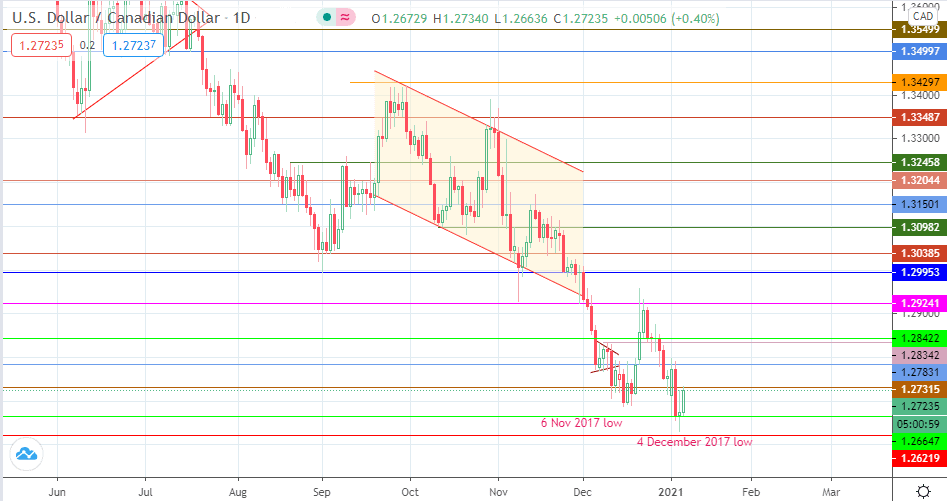

The expectation is for the US to outperform Canada in terms of the employment data. If this expectation is met, the USDCAD may continue its recovery. However, this is hinged on its breaking beyond the 1.27315 resistance, which has capped Thursday’s daily candle. This move opens the door towards 1.27831, or 1.28342. Additional resistance also lies at 1.28442.

However, if the Canadian employment data set is better than that of the US, we can expect the USDCAD to resume the downtrend. This downtrend resumption follows the pullback move of the last two days. This move could find momentum from rejection at 1.27315, targeting 1.26647 or 1.26219.

USDCAD Daily Chart