- Summary:

- Gold price (XAU/USD) action could be stirred up strongly by the 1st edition of the Non-Farm Payrolls report of the year, coming on the back of USD weakness.

Gold price action is expected to set up pretty well for traders wanting to trade the Non-Farm Payrolls report at 1.30 pm UTC. The markets expect NFP to have worsened from November 2020. An increase in the unemployment rate from 6.7% to 6.8% and a drop in the number of job additions from 245K to 68K are on the cards. These figures reflect the market expectations of a country that has struggled to deal with the 2nd wave of the coronavirus pandemic, despite the onset of vaccinations.

What is the playbook for traders who are interested in cashing in on the action?

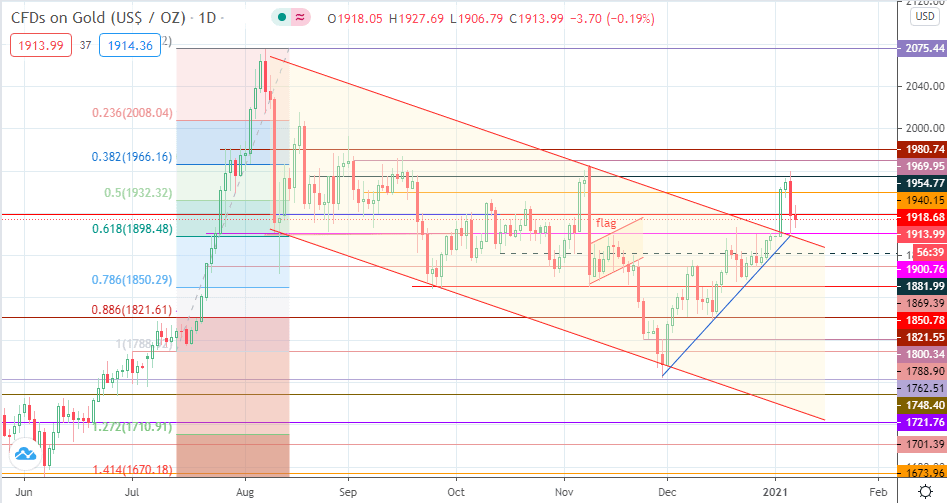

Trading the US NFP With Gold Price: Technical Levels to Watch

This is a straight forward play. A drop in NFP below 68K + unemployment rate of 6.8% or more is deemed USD-negative.

The playbook here would be to watch for a bounce on the channel’s upper boundary or the 1900.76 support on the XAU/USD daily chart. This move targets 1918.68 or 1940.15 initially. A bad result accentuates the pre-existing USD weakness and may bring in 1954.77 or 1969.95 into the mix.

Conversely, the NFP would have to be very good for the USD to experience a positive response. An employment change of at least 400K with unemployment at 6.7% or lower could be the trigger to sell the XAUUSD, provided the move takes out 1900.76 or re-enters the channel. Targets would be at 1881.99 initially, with 1869.39 and 1850.78 also serving as additional downside targets.

A conflict situation (better-than-expected employment change and higher unemployment, or a shortfall in employment change with a lower unemployment rate) could produce a choppy reaction in the first few hours of the trade action.

Thereafter, the USD’s status quo ante may determine the direction of the XAU/USD pair.

Gold Price (XAU/USD) Daily Chart