- Summary:

- What is the Nexo price outlook? We explain why we are moderately bearish even as the company launches a $100 million buyback.

The Nexo price retreated on Tuesday morning even after the company announced a major $100 million buyback program. The token is trading at $3.2585, which is a few points below Monday’s high of $3.7242. NEXO has jumped by more than 140% from its lowest level in October this year.

What happened? For starters, Nexo is a large and fast-growing blockchain company. It operates a website and mobile apps that serve millions of customers globally. It has raised more than $52 million from investors in its journey.

Nexo offers several products. For example, it has an exchange where people can buy and stake cryptocurrencies like Bitcoin and Avalanche. It also has a yield product where people can earn a return by just depositing their cryptocurrency.

Nexo also has a lending product, where one can borrow money using cryptocurrency as a collateral. At the same time, it has a NEXO token, which has a market capitalization of more than $1 billion. This token provides additional services to its customers. For example, stakers who use NEXO earn a bigger return than those using other currencies.

Nexo buyback. On Monday, Nexo announced that it will launch a $100 million buyback that will reduce the supply of Nexo tokens. The new buyback comes a few months after the company ended its $12 million buyback program. This program will end in the next six months. It hopes that it will use the purchased tokens to make investments and strategic acquisitions.

Nexo price prediction

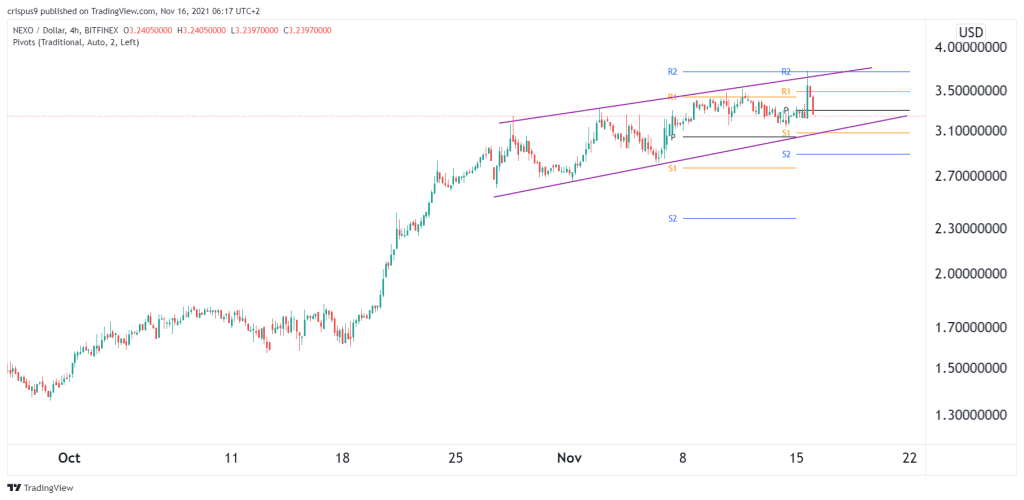

Nexo has been in an overall bullish trend in the past few months. This turned around this week as the coin has dropped from a high of $3.7242 to a low of $3.285. Along the way, the Nexo price has moved below the standard pivot point. It has also moved to the middle of the ascending trendline that is shown in purple.

Therefore, for now, while the overall trend is bullish, I suspect that the coin will keep falling as bears target the lower side of the ascending channel at $3.00. This level also coincides with S1 of the standard pivot points.