- Summary:

- Nexo Card is a new entrant in the crypto cards market, but it could be disruptive. We discuss how it works and what it brings.

Table of Contents

The world of decentralized finance has exploded over recent years, now holding a total locked-in value of $239 billion. While cryptocurrency is now a continually used digital currency, there has always been a disconnect between cryptocurrency as a decentralized asset and its application in real-world commerce.

While yield staking and contributing to liquidity projects is one way to use cryptocurrency, alongside governance and utility tokens, many individuals still worry about its use in the real world. Especially considering that 96% of Americans don’t understand what cryptocurrency is or any of the fundamentals of how it works, it’s not hard to see why businesses are worried about accepting crypto as a payment for services or products.

Change happens slowly, and we doubt that many people are expecting to be able to pay for their weekly shop in Bitcoin anytime soon. However, some companies are coming up with unique and innovative ways to bridge this gap. One of these said businesses, Nexo, has released a credit card that’s tied to cryptocurrency as a form of collateral.

In this article, we’ll be exploring Nexo, demonstrating how their product is set to bridge the divide between financial systems, and reviewing its core features. Let’s get right into it.

What is the Nexo Card?

The Nexo Card is a credit card that allows you to buy things in your everyday life without having to sell your cryptocurrency. While linked to your cryptocurrency accounts, when you make a payment, your crypto isn’t sold and converted into a fiat currency. On the contrary, Nexo gives you fiat, using your crypto as collateral for repayment. As this is done completely automatically, there is never a selling event, meaning a taxable event is never triggered.

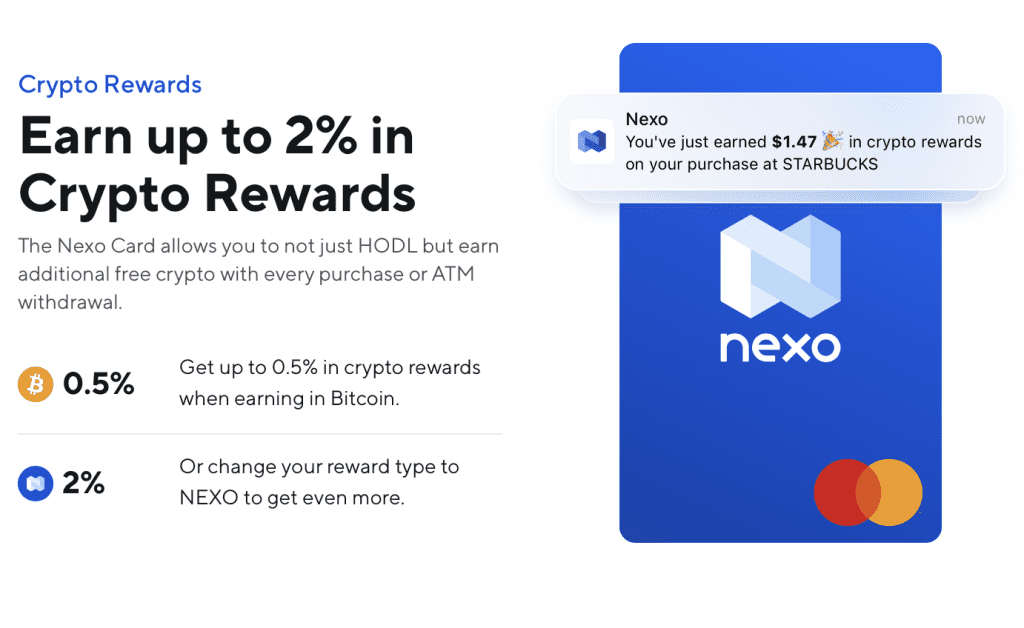

Going beyond just providing an accessible way to use your cryptocurrency every single day, Nexo offers up to 2% cashback in crypto on every purchase that you make. You’ll be able to generate additional crypto in either Bitcoin or NEXO, with this credit card rewarding you as you use it.

Within this card, credit line rates start at 0%, never going beyond 13.9% in the most extreme of cases. What’s more, you can enable a 0% APR option, which will ensure that your account always deposits enough collateral to keep your LTV below the standard 20% rate. With this, you can always benefit from 0% dynamic interest, even when using your card on a daily basis.

With functionality that allows you to connect the card to Google and Apple pay, Nexo provides a comprehensive credit card benefits system that has cryptocurrency at its core. While retaining total ownership of your assets, you’re able to open credit lines that your purchases will deduct from. This turns your digital assets into collateral, ensuring you can use your crypto to pay without having to sell into a fiat currency.

For all users of Web 3 or blockchain enthusiasts, this is a huge project which is turning heads all over the community.

Key Features of the Nexo Card

As a card that ties your crypto assets to a fiat currency, allowing you to open lines of credit without actually selling your crypto, the Nexo Card has a range of features that underpin its design.

Each of these features targets a different audience, providing further utility to its customers and users. Here are some of the most popular features of the card:

- Optimized Tax Liabilities

- Rewards and 0% APR

- No Minimums

- Travel and Earn

- Card Control

Let’s break these down further.

Optimized Tax Liabilities

When you sell your crypto, you’re creating a taxable event that would require you to document this sale and calculate the amount of earnt from the moment you bought the crypto to the moment you cashed out. Even if you’re only cashing out to buy something small, you would have to respond to this taxable event every single time. Due to this, many people that invest in crypto never want to cash out to buy with fiat currencies as they know the hassle that comes with it.

To solve this problem, Nexo provides a line of credit on your crypto. This means that instead of actually selling and causing a taxable event, you’re able to spend fiat without having sold anything. With this, you never have to declare a sales event, as one never occurred.

In short, the Nexo card allows you to use your crypto without accidentally triggering any tax events that you have to document.

Rewards and 0% APR

A huge benefit and draw to the Nexo card is the fact that you’re able to get funds that start at 0% APR. Even at the most expensive level of return, Nexo caps its rates at 13.9%. Considering that the average credit card in America has an APR of 19.0%, the Nexo card offers a significantly better deal for its users.

What’s more, alongside having low rates for any outstanding payments, the Nexo card allows you to generate money back on every single payment you make. But, sticking true to its decentralized origins, this card actually returns you cryptocurrency.

You can choose between two different cashback settings, depending on which you’d prefer out of 0.5% BTC or 2% NEXO. Within this, you’re able to get a continual cashback flow from your purchases, including any ATM withdrawals that you make.

Over time, this can rapidly add up, allowing you to get more crypto over time from using your Nexo card.

No Minimums

Unlike some credit cards that ask users to use the card for a minimum amount of money each month, the Nexo Card operates on a strict no-minimum-spending across the entire year. No matter whether you’re looking at annual or monthly structures, there are absolutely no minimum repayments or inactivity fees for you to have to deal with.

Due to this, you’re able to use your Nexo Card only when and if you actually want to. There is no risk involved, meaning you can sign up and never use the card again if you didn’t want to. Without minimums or activity risks, you’re able to completely control your finances, using the card exactly how you’d like.

Travel and Earn

As the world opens up again after the pandemic, globalization is back to an all-time high. With the ease of traveling from one country to another, more people than ever before are now taking holidays or even completely working abroad. With this in mind, Nexo has developed a travel and earn section of their card.

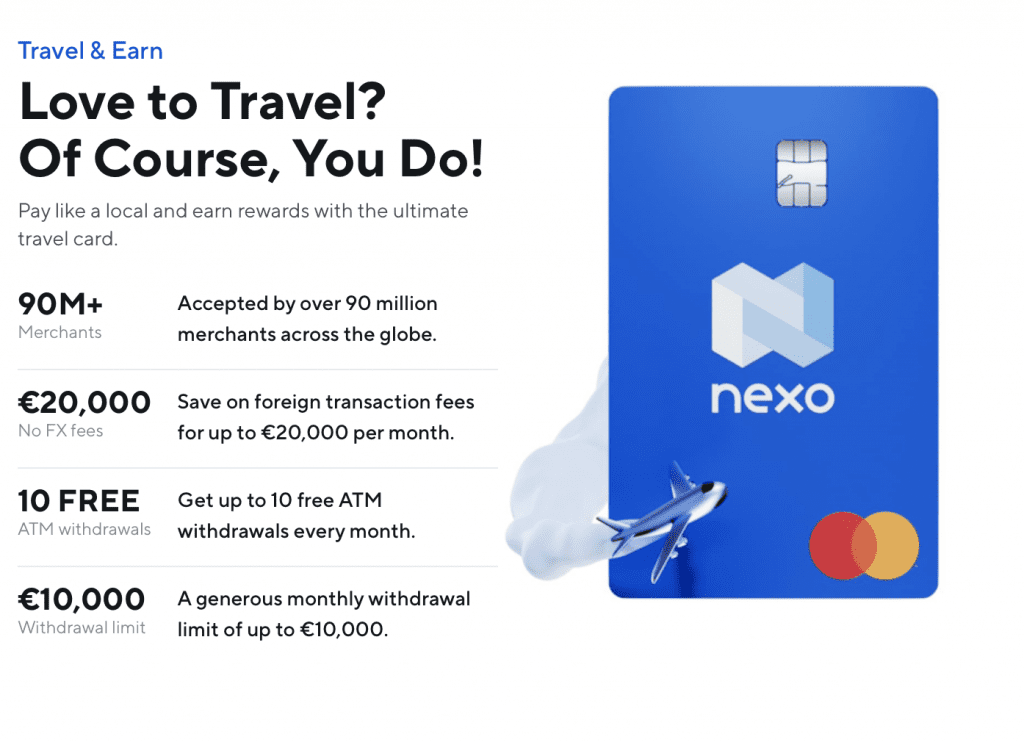

With travel and earn, you’re able to pay with your Nexo card with over 90 million different merchants around the globe. With absolutely zero FX fees up to $20,000 per month, you’re able to pay naturally wherever you find yourself in the world.

Equally, if you’re on the go, you can make up to 10 free ATM withdrawals, ensuring you have enough cash to get you through the month. With a monthly cap of $10,000, you’ll have more than enough when you touch down on your vacation.

Card Control

The integration of the Nexo card with its app is seamless, with the app granting the user a range of additional functionality. If, at any point, you lose your card or misplace it, you’re able to access the application and freeze your funds. This means that anyone who attempts to use the card won’t be able to, ensuring you’re the only one that can access your funds.

Equally, you can change your pin with the tap of a button, giving you total control over how you use your card and keep it safe. With features like these built-in to the application, the functionality of the card is deeply impressive, mirroring leading internet banks like Revolut or Starling.

These features are only a fragment of what Nexo offers, with their comprehensive service helping to bridge the world between decentralized and centralized financial payments.

How does Nexo Card Approach Security?

Nexo takes security seriously, providing a comprehensive level of digital security that has you at its core. Alongside strictly complying with international regulations and AML and KYC standards being followed, they have built a range of security features into their card.

For example, the application that is connected to your Nexo card will give you a range of different potential security features, such as:

- Two Factor Authentication – From SMS Verification and email verification to external authenticator app integration, you’re able to construct several different layers of security that you can use. Whenever you want to sign in to your account, you’ll be able to verify your identity before you begin.

- Biometric Identification Systems – Nexo allows for FaceId and Fingerprint locking of your account, meaning that only your biometric information can unlock your account. With this, you can rest assured that you’re the only person that will have access to your funds.

- Whitelisting – Within the application, you can whitelist your crypto addresses, further increasing the security on your account by narrowing the scope of the application to your personalized linked accounts.

- Records – Just in case, Nexo keeps extensive records on every single transaction, with this log detailing the IP address of where the card was used, as well as the location. You can even set up log alerts to notify you whenever your card is used.

Alongside these in-app features, Nexo boasts a whole range of security features, such as security standard level-three cryptocurrency defenses, data protection and confidentiality clauses, and an information security management system. To say they take your security seriously would be a serious understatement.

What’s more, Naxo has partnered with BitGo, Ledger, and bakkt in order to provide up to $775,000,000 in digital assets completely covered. With this, you won’t have to worry about fraudulent activities on your cards eating into your funds, as you’ll always be able to fall back on this comprehensive financial regulation that keeps you safe.

Final Thoughts

If you’re looking for a comprehensive, compliant, and beneficial way to use your crypto without selling, then the Nexo Card is the total package. Offering credit lines with your crypto as collateral, you’re able to make daily purchases without having to sell any of your digital assets. With this, crypto is converted into a highly-functional tool, allowing you to buy anything in the real world.

Nexo Card is a game-changer when it comes to expanding the utility of blockchain systems in the world of finance. While DeFi focuses exclusively on the decentralized market, this card bridges the gap, bringing DeFi payments to centralized economies and expanding their usage.

For anyone interested in the utility of blockchain, the Nexo Card is an unforgettable project that you should be turning to. We can’t wait to see what else they announce in the following months.