- Summary:

- The Boohoo share price could be impacted by the new EU-wide waste fees in yet another layer of challenges facing the stock.

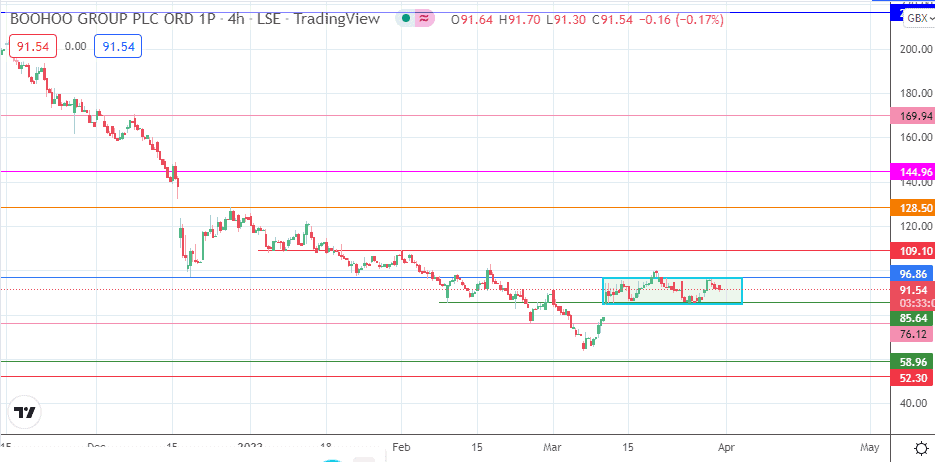

This Thursday, the Boohoo share price is down 0.26% and looks set for a second consecutive losing day unless the bulls turn things around in late UK trading. The decline follows a rejection at the 96.86 resistance on Wednesday after an unsuccessful attempt at a breakout on Tuesday.

The trigger for the Boohoo share price fall has roots in the latest EU ruling on waste generated by the fashion industry. Boohoo and Zara are clothing brands characterized as “fast fashion” brands. Under the new EU-wide Extended Producer Responsibility Scheme, they could now face potential “waste fees” for every item they sell.

The scheme is designed to make fast fashion brands adopt ecologically-friendly processes for their work. Polyester (a fossil-fuel derivative) use in clothing materials has risen significantly in the last twenty years. With people buying clothes more regularly and not keeping them as long as before, these clothes are ending up in landfills, incinerators, or waste outlets and are contributing to global warming and ecological degradation.

Boohoo and other fast fashion brands would have to make radical changes to avoid paying these fees. This adds a new layer of obstacles to the indoor-clothing maker, which has seen a steep decline in its share price as people return to work and play after lockdowns were lifted in the UK.

Boohoo Share Price Outlook

The 4-hour chart shows that the Boohoo share price is trading within a range formed by the 96.86 price ceiling and the 85.64 price floor. This is the range that must be broken for the price to define a new trend direction in the short term. The preceding minor trend is an uptrend, which favours a bullish continuation. This sentiment requires the bulls to break the 96.86 price resistance, targeting a measured move towards 128.50. This move is dependent on the bulls taking out the 109.10 price mark to be fulfilled. 144.96 is an upside target that remains out of reach at the moment.

On the flip side, the bears would be seeking a breakdown of the 85.64 floor, targeting 76.12 initially (24 February low) before 58.96 enters the picture as a multi-month support level. The 29 June 2016 low at 52.30 is a different target to the south that requires a breakdown of the 15 July 2016 low at 58.96 to become available.

Boohoo: 4-hour Chart