- Summary:

- The new Digital Markets Act passed by the European lawmakers could impact Amazon stock price forecasts going forward.

Several days of continuous gains on Amazon’s stock could soon face a stiff test, as the market reacts to potential headwinds from Europe in a move that could stimy bullish Amazon stock price forecasts. EU regulators look set to apply new strict digital rules to rein in what it views as big tech’s undue market power. To this end, Eu lawmakers have agreed on a new set of provisional rules under the Digital Markets Act.

This Act, which was unveiled on Thursday by the EU, seeks to limit the powers of Amazon, Meta Platforms (formerly Facebook), Alphabet and Microsoft from exerting undue influence in the market to prevent access to user data by other companies.

These rules specifically target amazon and other big tech companies as they exceed the $82 billion market cap/45 million monthly users minimum limit. The rules require users of the services of these companies to be able to delete pre-installed apps on their devices, provide enterprise users with access to their user data, and stop promoting their products over those of their rivals.

The new regulation allows the European Commission to impose heavy fines, up to 10% of turnover from worldwide operations, and double this for repeat offences. The European Parliament must ratify the Digital Markets Act before it takes effect, and it could impact Amazon stock price forecasts in the future.

Amazon Stock Price Forecasts

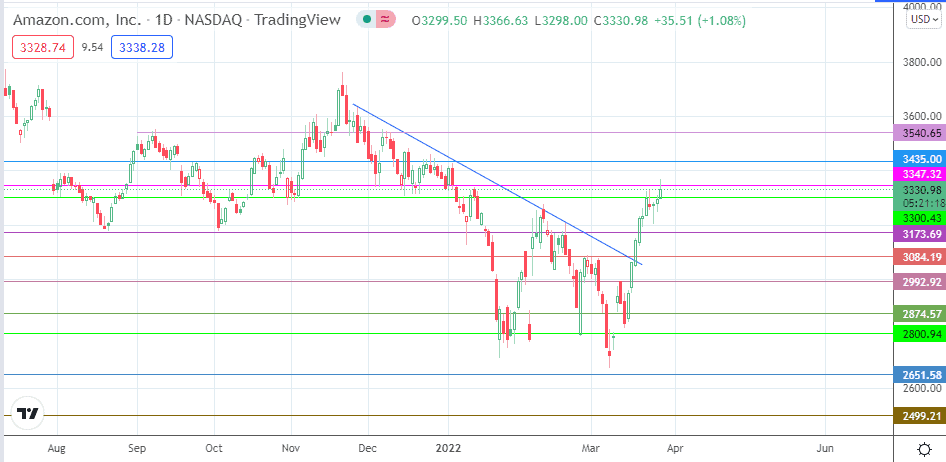

The break of the descending trendline at the 3084.19 resistance level (25 October 2021 and 12 January 2022 highs) has allowed the Amazon stock price to push higher, targeting the completion of the measured move at 3540.65. First, however, the stock must contend with an immediate resistance barrier at 3347.32. If the bulls uncap this barrier, 3435.00 (23 September/28 December 2021) becomes the only resistance to the measured move.

Conversely, rejection at the 3347.32 resistance allows for a pullback that targets 3300.43 initially (29 September/3 November 2021 lows) before 3173.69 enters the picture on further price deterioration. 3084.19 and 2992.92 are potential downside targets that require a further price decline to become viable.

Amazon: Daily Chart