- Summary:

- Netflix stock price was up by 1.5 percent in yesterday's trading session, continuing the previous day's bullish move.

Despite Netflix closing the markets with a 1.5 percentage gain in yesterday’s trading session, the company is struggling in the markets. Recent reports indicate that the company plans to lay off 300 employees across the company. The cut, which comes a month after the company laid off about 150 positions, will represent 3 per cent of the company’s staff.

The recent layoffs are in response to the lagging stock prices and a continued loss of subscribers. In a statement released by Netflix, the company indicated the decision was reached as a solution to adjust their cost of operations to be in line with the slower revenue growth.

In April, Netflix had already sounded the alarm that they would be looking to cut back on their spending to address the falling revenues. The recent reports also come amid a continued loss of subscribers.

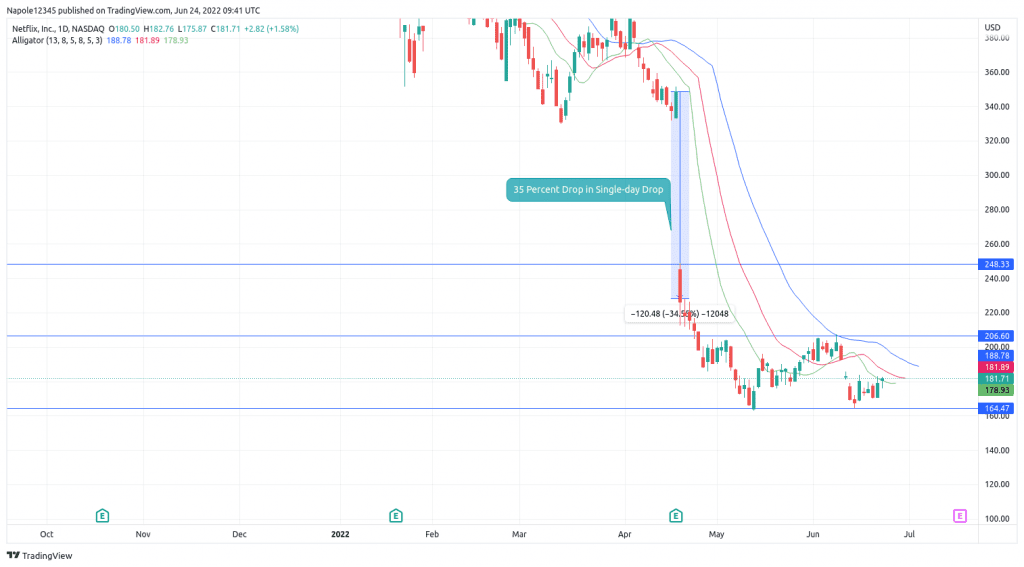

In April, Netflix announced, for the first time in a decade, that it had lost subscribers. The number of subscribers lost, which was 200,000, was also significant enough to cause a meltdown in the markets that resulted in Netflix shares dropping by 35 per cent in a single day, shedding $54 billion in market capitalization.

Netflix Stock Price Forecast

Netflix closed the markets up 1.5 per cent in yesterday’s trading session. It was also the second consecutive day that prices were gaining in the markets. The bullish trend is also likely to continue following reports that the company was seriously considering moving to an ad-based subscription for some of its users.

According to reports, the ad-based model would not affect the current subscribers. However, those who want their subscription fees reduced would have to agree to watch ads. If the plan goes through, there is a high likelihood the company will reduce the estimated 2,000,000 subscribers expected to be lost this year.

It will also help the company start to recover, and we might see this translated to the markets, where the shares start to rise. It is likely that we will see Netflix trading above the $250 price level again if that happens. Deteriorating market conditions, however, will invalidate my Netflix bullish analysis. It will also mean a continued loss of subscribers and a loss in the markets.

Netflix Daily Chart