- Summary:

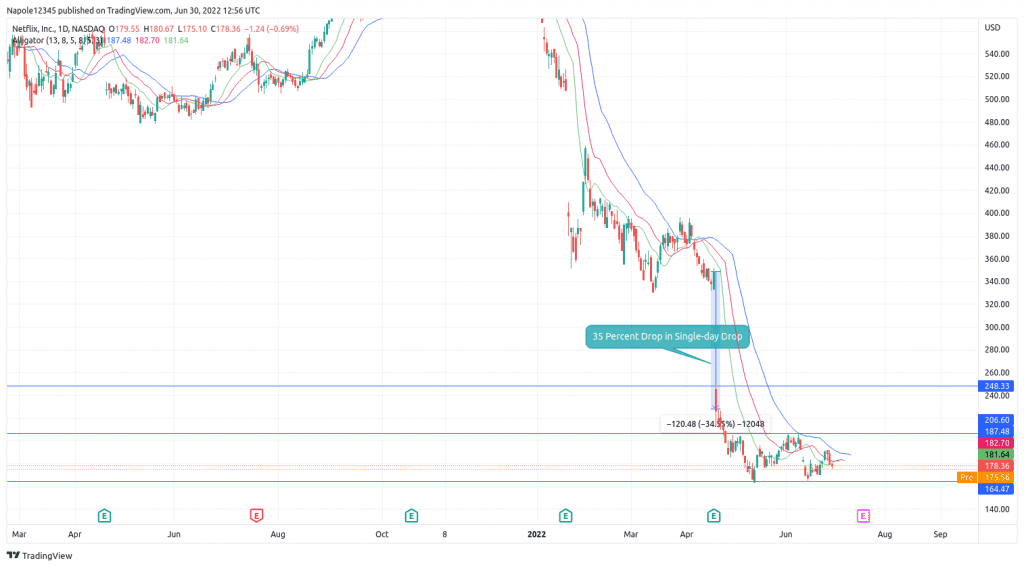

- Netflix stock price is looking aggresively bearish in today's trading session. The trend is also looking highly likely to continue.

Netflix stock price continues to plummet, with the company losing 6% this week. Yesterday, the prices closed the markets with almost a percentage price loss. The pre-market trading also shows a strong market sell-off, which could also mean a further drop after it opens.

Why is Netflix’s Stock Price Falling?

The current situation with Netflix’s stock price is worse, even compared to other similar tech companies that have had a terrible year. For starters, the past two quarters have seen the company release disappointing financial reports that have greatly impacted its investors. Netflix has also been on a cost-cutting run in the last few months, firing more than 450 employees.

The Netflix stock price currently sits 70 per cent below its 2022 opening price. The stock’s underperformance has also persisted throughout the year, resulting in a drop of 9% this month. Many investors have questioned this underperformance, with major shareholders jumping ship and causing prices to continue dropping.

New investors looking for opportunities at the Netflix stock price have also been put off by its growth projection. Recent reports about its struggle to keep its users have also compounded Netflix’s problems, causing it to reverse its longstanding principles, such as introducing an ad-based subscriber tier to the platform and cracking down on password sharing.

On top of the company’s changing its tune on certain principles, the current economic climate conditions, including inflation and a looming recession, have also put the company in a bad spot. In addition, the rising cost of living has also seen most of the platform’s subscribers leave the platform due to its affordability after the company raised its subscription fees.

Netflix Share Price Analysis:

My Netflix share price analysis expects the bearish trend to continue with the current market conditions. As a result, we will likely see prices fall below the recent price low of $165 and possibly push the downside. On the flip side, the drop will allow long-term investors to get into the markets at a discount.

Netflix Daily Chart