- Summary:

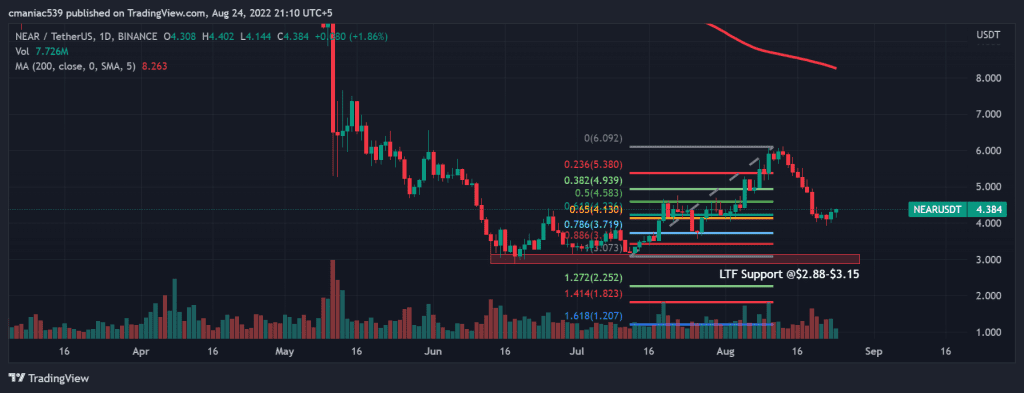

- For our Near Protocol price prediction to flip bullish, price needs to break above the $6.11 level. Currently, price is trading at $4.30.

The Near Protocol price prediction could flip very bearish if the price gains acceptance below a key level. NEAR crypto price has been in a downtrend since its rejection from $6.11. Currently, the price is trading at $4.34 after gaining 1.5% during Wednesday’s trading session.

Most altcoins have broken below their key supports as Bitcoin and Ethereum failed to reclaim key levels. Consequently, the markets are experiencing increasing sell pressure as investors are taking a cautious approach.

Near Protocol price has been in a constant downtrend since the end of May. This negative price action coincides with the Bitcoin slump during the same time. Nevertheless, the coin generated 100% returns in a relief rally that took the price from $3.04 to $6.11 within 30 days. You can buy NEAR coin by signing up on a top crypto exchange like Binance.

According to Near Protocol news, the Nearcon 2022 will be taking place in Lisbon from 11th to 14th of September. The event would give 2000+ attendees an opportunity to build lasting connections, have insightful discussions and take part in hackathons. As per DeFi Llama, the protocol TVL has decreased by more than 40% within the past 3 months.

Near Protocol Price Prediction

Technical analysis of the NEAR USD price chart suggests that the relief rally that started in the mid of July is over. The closure of the price above the 0.618 Fib region is a sigh of relief for the bulls. A daily closure below this level could send it to the July lows. Therefore, it is very critical for the price to hold this level and generate a strong bounce. Reclaim of the $5.32 level would give investors a lot of confidence to aim for further upside.

There’s also a scenario that gives us a bullish Near Protocol price prediction. For this to happen, the price needs to break above the $6.09 level. An acceptance above this level would give bulls enough momentum to tag the 200-day moving average that currently lies at $8.26.

NEAR Protocol Daily Chart