- Summary:

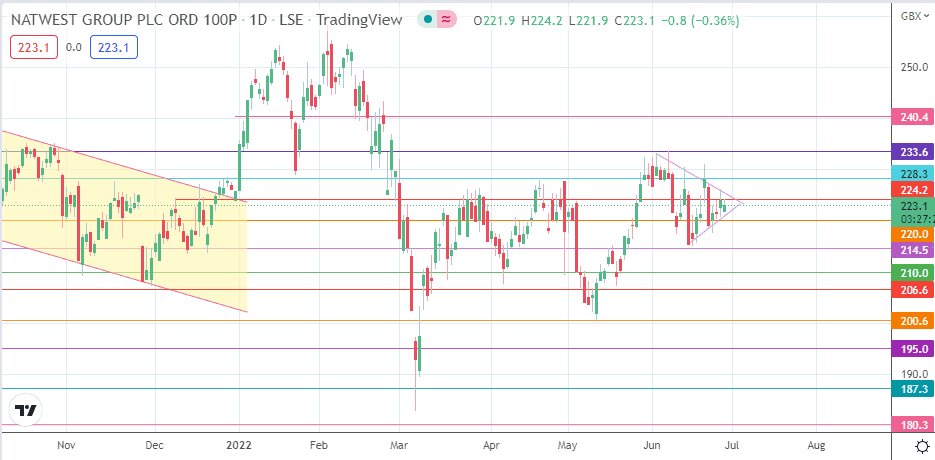

- The Natwest share price could hit 240p if the price action within the symmetrical triangle breaks to the upside.

This Wednesday, the Natwest share price remains in negative territory even as the bulls aim to recover lost ground following the deeply negative open.

The Natwest Group had on Tuesday priced $1 billion worth of senior callable fixed-to-fixed rate notes due in 2028. The notes come with a 5.516% yield, and issuance will close tomorrow. The proceeds from this note issue, minus any expenses incurred and underwriting discounts, will be used to fund the general banking business of the Natwest Group.

The Natwest share price hit its highest level in June after the British government said it would not sell more than 15% of the group’s total trading volume in the next 12 months. With this decision, the UK government extended the sale of its remaining shareholding in the bank until August 2023. Recall that the UK government nationalized the bank in the wake of the 2008 global financial crisis to save it from collapse.

The Natwest share price is trading 0.18% lower as of writing.

Natwest Share Price Forecast

The price action is trading within the confines of an emerging symmetrical triangle. With the price action close to the triangle’s apex, the price candle is testing the resistance at the 224.2 price mark (22 March, 5 May and 27 June highs). A break of this level allows the bulls to push for a breakout from the triangle. This breakout is achieved when the bulls aim for the 228.3 resistance (24 December 2021 and 21 April 2022 highs).

Above this level, the 233.6 price level (5 January low and 9 June high) is the next target in line with a price advance. Finally, attainment of the 240.4 resistance level (24 February low and 18 February high) completes the measured move from the pattern.

On the flip side, rejection at the 224.2 resistance puts the lower border of the triangle in jeopardy. A breakdown of this level and the 220.0 psychological support (27 April and 4 May lows) opens the door toward the 214.5 support level. Below this area, 210.0 and 206.6 are additional price targets to the south. Finally, the 12 May 2022 low at the 200.6 price mark is another potential harvest point for the bears, which becomes active on further price deterioration.

Natwest: Daily Chart