- Summary:

- The Natwest share price gained for the third day in a row as the investors paid no heed to the bank's guilty plea over the spoofing scandal.

The Natwest share price has defied the negative news regarding its guilty plea for market manipulation and has pushed 0.71% higher on the day. However, the FTSE-listed stock appears to have stalled around the 16 December highs.

This move comes as the Natwest Group’s investment banking division pled guilty to wire fraud and securities fraud from historical spoofing, said to have been carried out in the US Treasury markets over a 10-year interrupted period from 2008 to 2018.

The bank will pay $35million in criminal fines and restitution after some identified employees in London, Singapore and Connecticut fraudulently opened and cancelled orders on US Treasury contracts with the intent to deceive market participants on the true state of demand and supply. This action, known as spoofing, is illegal according to securities laws.

The bank said it had identified the individuals involved and had dismissed them following an internal investigation.

Natwest Share Price Outlook

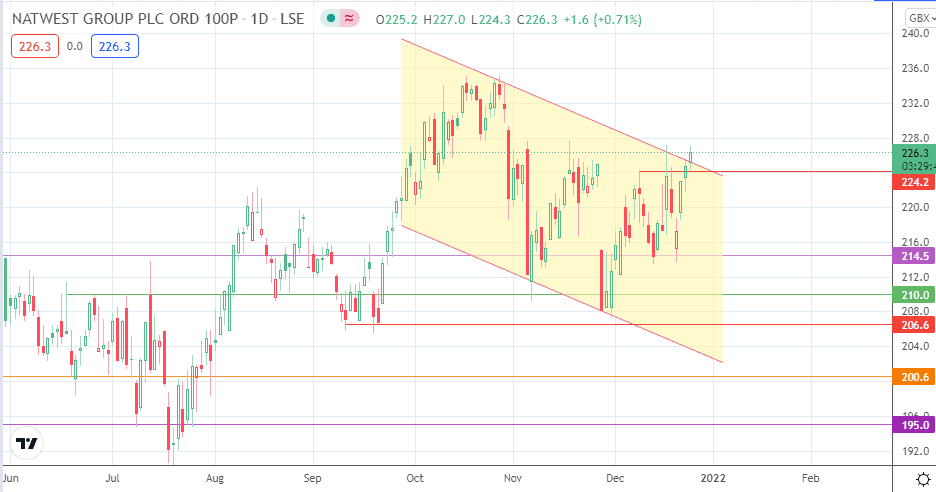

The intraday uptick in the stock has pushed the Natwest share price above the upper edge of the descending channel.

This uptick puts the stock closer to challenging the resistance at 228.3. A break above this level brings the 233.6 resistance into the picture as a potential target to the north.

On the other hand, a decline from current levels or a rejection of the uptick at the 228.3 resistance, allows the bears to aim for the 220.0 price support. 224.2 may constitute a pitstop for this move. It will take an aggressive selloff to drive price below 220.0, targeting 214.5 and 210.0 as the future downside targets. 206.6 is a pivot that is presently beyond the reach of the bears.

Natwest: Daily Chart

Follow Eno on Twitter.