- National Grid share price has staged a strong recovery in the past few days as investors buy the recent dip. What next for the NG stock?

The National Grid share price has staged a strong recovery in the past few days as investors buy the recent dip. The NG stock is trading at 1,123p, which is about 10% above the lowest level this month. This rebound has brought the company’s market cap to about 49 billion pounds.

National Grid is a leading utility company.

National Grid is one of the biggest utility companies in the world. The company operates in several segments, including UK electricity transmission, UK electricity distribution, UK electricity system operation, New England, New York, and NGV. Its electricity transmission division is the biggest part of its business, generating over 2 billion pounds in revenue.

In May this year, the company published relatively strong results for the full year that ended in March. The firm’s operating profit rose by 82% to over £4.3 billion while its profit before tax rose to over £3.44 billion. Its dividend per share also rose by 4% to 50.97p.

This performance happened in a relatively busy year for the firm. For example, the management spent £7.9 billion to acquire Western Power Distribution, the biggest distributor in the UK. It also sold a 60% stake in National Grid Gas to Macquarie Asset Management and British Columbia Investment. The sale is expected to complete this year. Further, it sold its 50% stake in St William Homes JV.

The National Grid share price has risen as the company embarks on its biggest investment plans on record. The firm plans to spend £54 billion to upgrade the country’s energy network by investing in offshore wind energy. This is in line with the government’s goal of achieving 50 gigawatts of offshore wind by 2030. In addition, it hopes to use the electricity transmission charge that customers pay every month.

National Grid share price forecast

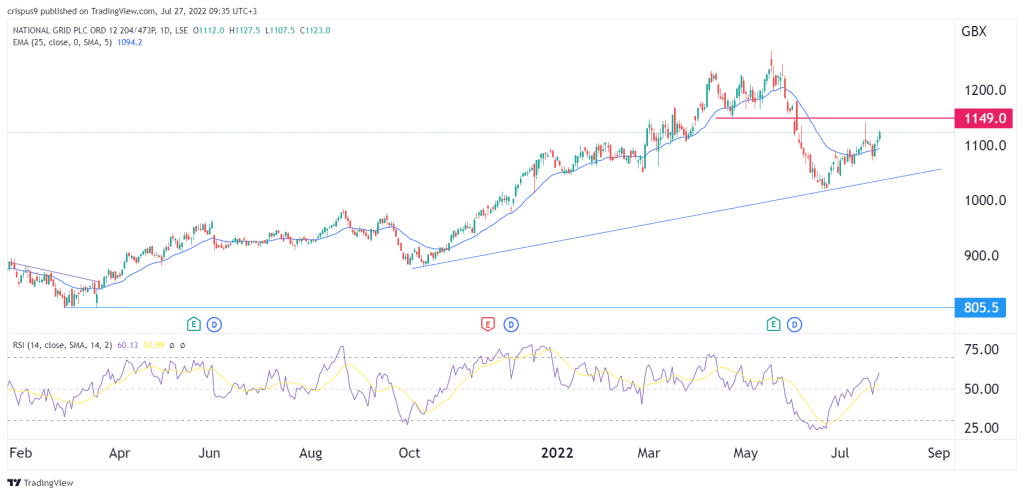

The daily chart shows that the NG share price has been in a strong rebound in the past few days. The stock has moved above the ascending trendline that is shown in blue. In addition, it has moved slightly above the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has risen above the neutral point at 50.

It also attempts to retest the double-top pattern’s chin at 1,150p. Therefore, because of this break and retest pattern, I suspect that the shares will resume the downward trend soon and test July’s low of 1,023p. On the other hand, a move above the resistance at 1,150p will invalidate the bearish view.