- Summary:

- Wall Street indices started higher the day with the Nasdaq on positive foot adding 0.06% higher at 8,208.02. The Dow Jones Industrial Average currently

Wall Street indices started higher the day with the Nasdaq on positive foot adding 0.06% higher at 8,208.02. The Dow Jones Industrial Average currently is trading 0.14% higher at 27,220, while the S&P 500 trading 0.09% at 2,988.5 after United States Redbook Index (year over year) came in at 4.9% for July 19, versus 4.7%. United States Redbook Index (month over month) up to 1.1% in July from previous 1%, and the United States Housing Price Index (month over month) came in at 0.1% below expectations of 0.3% in May.

Trade tensions between the China and US showing some signs of progress as President Trump looks to ease the ban on Huawei. China will proceed with the purchases of US soybeans, if the USA ease the restrictions on Huawei. U.S. negotiators will likely visit China next week for their first face-to-face trade talks with Chinese officials since the G20 meeting. Traders’ attention focused on the Fed policy meeting next week as hopes of a 50 bp cut to interest rates began to fade.

Time to Sell?

I expect slower economic growth in the USA and internationally, as trade and geopolitical tensions increase, but the upcoming interest rate cuts from major central banks will act supportive for Nasdaq and the other equity indices.

President Trump, a long-time critic of the Fed, called on the central bank to make “deeper” cuts at its next meeting.

I still believe that the global reflation scenario is intact and easier credit conditions from most of the major central banks, including the Fed, are coming and will be the dominant fundamental that supports global equities in the long term. Futures markets are predicting almost a 100% probability that the FOMC will lower its fed funds rate by 25 basis points at its July 30-31 monetary policy meeting. A second rate cut is anticipated before the end of the year.

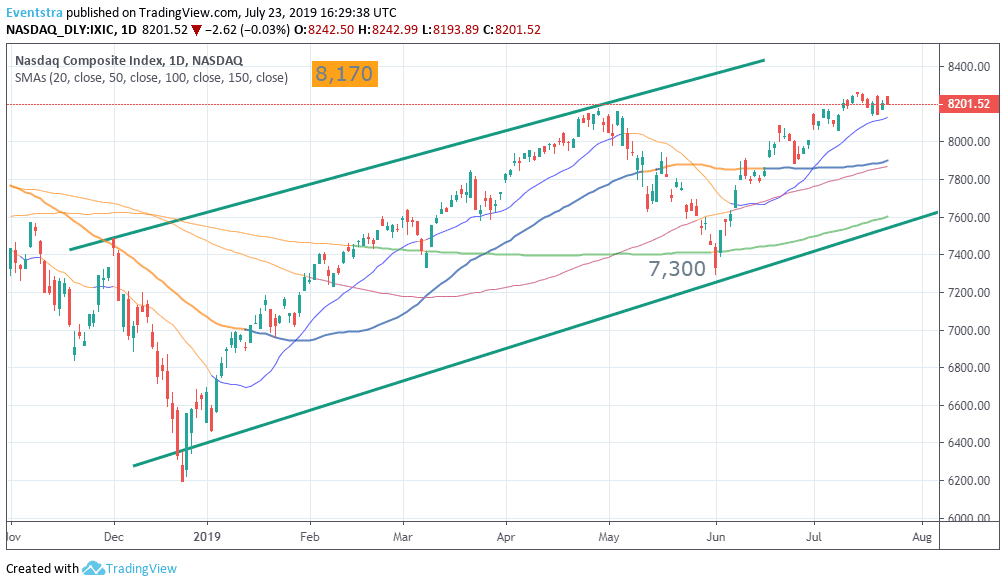

Nasdaq trading above all the key daily moving averages and the bulls are ruling the game for the short term while for the midterm is on a rising trend channel. On the upside immediate resistance is at 8,243 the daily high and then at 8,257 the high from July 15th. On the downside Nasdaq first support stands at 8,198 today’s low and then at 8,130 the 20 day moving average while more bids will emerge at 7,900 the 50 day moving average. Traders looking to enter long positions can buy if the index manages to close above 8,213, targeting the 8,257 level for profits, and can keep their long positions as far the index is trading above the 8,198 mark.

The European Indices ended higher, the FTSE 100 underperformed, as Boris Johnson is the new UK Prime Minister, finished 0.56 percent higher at 7,556 as the pound trades above 1.2440. DAX 30 ended 1.64 percent higher to 12,490 while CAC 40 in Paris also finished 0.92 percent higher at 5,618.

Facebook Earnings July 24: Download our free FB earnings preview report today.

Don’t miss a beat! Follow us on Twitter.