- Summary:

- Wall Street indices slumped today with the Nasdaq giving up 2.56% lower at 7,799.40. The Dow Jones Industrial Average currently is trading 2.06% lower

Wall Street indices slumped today with the Nasdaq giving up 2.56% lower at 7,799.40. The Dow Jones Industrial Average currently is trading 2.06% lower at 25,937, while the S&P 500 trading 2.07% at 2,871.55 after USDCNH rose to 6.9865 earlier today the highest level since 2017 as trade tensions between the China and US intensifies. ISM Non-Manufacturing PMI dropped to 53.7 in July, the lowest since August 2016 and below expectations of 55.5. The US Markit Services PMI came in at 53, toping forecasts of 52.2 in July

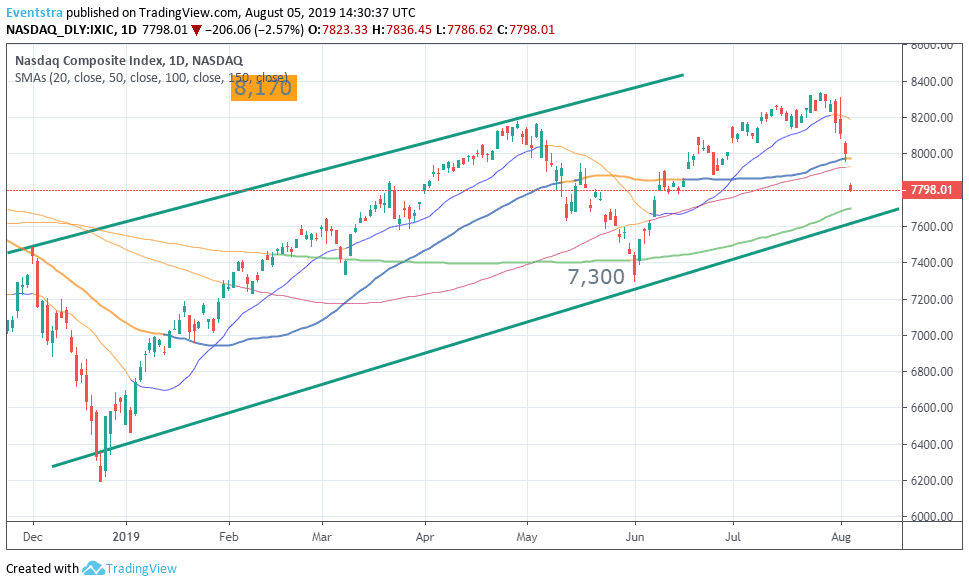

Nasdaq finished on Friday at the 50 day moving average at 7,971 and started with a gap down breaching the 7,929 level where the 100 day moving average crosses and the bears now are ruling the game for the short term while for the medium term is still trading on the rising trend channel. On the upside immediate resistance is at 7,836 the daily high and then at 7,937 the 100 day moving average. On the downside Nasdaq first support stands at 7,789 today’s low and then at 7,700 the 150 day moving average while more bids will emerge at 7,300 the low from June 3rd. Traders looking to enter long positions can buy if the index manages to close above the today’s high, targeting the 8,000 level for profits, and can keep their long positions as far the index is trading above the 7,700 mark.

The European Indices also trading sharply lower, the FTSE 100 underperforms as it is 2.45 percent lower at 7,223 as the pound trades above 1.2168. DAX 30 is 1.66 percent lower at 11,672 while CAC 40 in Paris also trades 2.02 percent lower at 5,248.Don’t miss a beat! Follow us on Twitter.