- Summary:

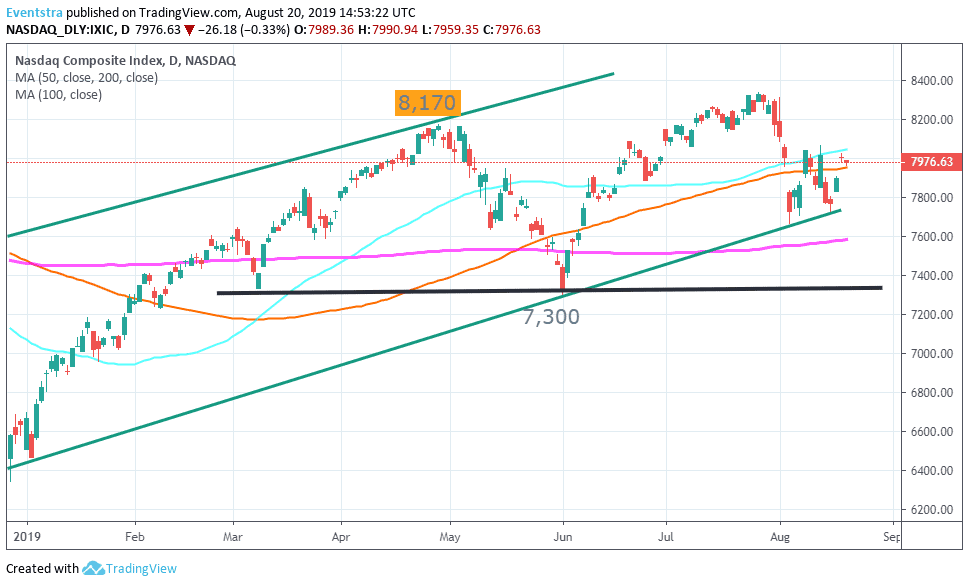

- Nasdaq retreats today after three positive consecutive days and might test the 7,951 support were the 100 day moving average crosses, while more bids will

Wall Street indices started lower today with the Nasdaq giving up 0.32% at 7,977.40. The Dow Jones Industrial Average currently is trading 0.31% lower at 26,057, while the S&P 500 trading 0.44% lower at 2,910.90 as trade tensions between the China and US returns. In United States the Redbook Index (year over year) climbed from previous 4.4% to 4.9% for August 16, the monthly reading for the Redbook Index came in at -1.7% versus -2%.

The CBOE Volatility Index (VIX) is 1.18% higher today at 17.08 just to confirm the cautious market mood.

Nasdaq retreats today after three positive consecutive days and might test the 7,951 support were the 100 day moving average crosses, while more bids will emerge at 7,727 the low band of the ascending channel. On the upside immediate resistance is at 7,990 the daily high and then at 8,044 the 50 day moving average. Traders looking to enter long positions can buy if the index manages to close above today’s high, targeting a break above 8,000 mark for profits, and can keep their long positions as far the index is trading above the 7,900 mark.

The European Indices also trading lower today, the FTSE 100 is 0.75 percent lower at 7,135 as the pound trades at 1.2127. DAX 30 is giving up 0.55 percent at 11,652 while CAC 40 in Paris also trades 0.54 percent lower at 5,345.