- Summary:

- The Nasdaq Composite Index underperformed today giving up 0.17 percent to 8,038.66 while the Dow Jones Industrial Average (DJIA) adds 43.42 points

The Nasdaq Composite Index under performed today giving up 0.17 percent to 8,038.66 while the Dow Jones Industrial Average (DJIA) adds 43.42 points, or 0.16 percent, to 26,794.31, and the S&P 500 trading 0.03 percent lower to 2,993.60. Wall Street is heading for third week in a row with gains. Geopolitical tensions have increased the last hours between the Iran and USA. A report overnight that President Trump approved military action against Iran but then pulled back from launching the attacks weighted on traders sentiment. Data released earlier today showed that Existing Home Sales Change came in at 2.5 percent beating analyst expectations of 1.2 percent for May. On Wednesday the FED kept interest rates unchanged, but changed language to more dovish. Neel Kashkari a dovish member of the FOMC called for a 50 basis point cut this week! New York’s FED latest Nowcasting Report, shows that the U.S. economy is expected to grow 1.4 percent in the 2Q and 1.3 percent in the 3Q of 2019. May was the worst month for stocks in 2019 amid US – China trade war concerns.

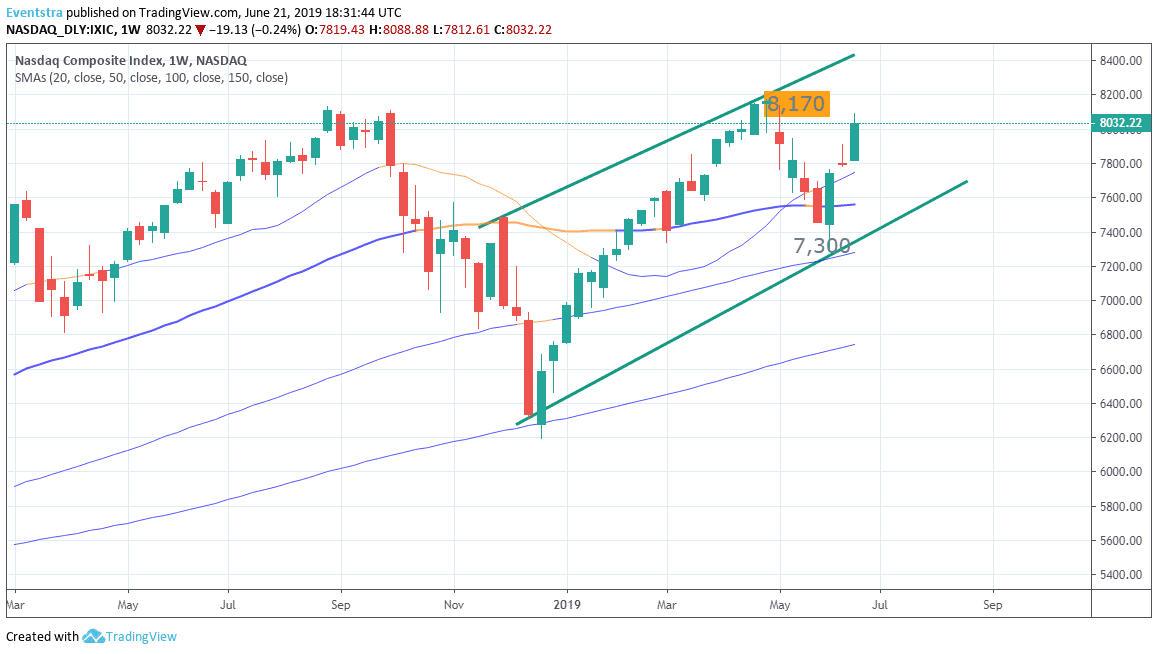

The index trading above all the key daily moving averages and the bulls are ruling the game for the short term while for the midterm is on a rising trend channel. On the upside immediate resistance is at the weekly high around 8,087 while more offers will emerge at 8,170 the yearly high. On the downside Nasdaq first support stands at 7,859 the 50 day moving average, while extra bids will emerge at 7,721 the 100 day moving average.