- Summary:

- Nasdaq breaks above the 100 day moving average and bulls are back in the game. On the upside immediate resistance is at 7,980 the daily high and then at

Nasdaq started sharply higher today adding 1.49% at 7,973 after China said it is not interested in escalating trade tensions, hinting that it may not retaliate with tariffs. The Dow Jones Industrial Average is 1.22% higher at 26,353, while the S&P 500 trading 1.21% higher at 2,923.72. The number of Americans filing for unemployment benefits increased as expected last week. The Initial Jobless Claims came in at 215K matching forecasts for August 23, the Continuing Jobless Claims came in at 1.698M, topping forecast of 1.68M in August 16. United States Gross Domestic Product Annualized came in at 2% in line with expectations for 2Q, 2019. The US Pending Home Sales (month over month) came in at -2.5%, below forecasts of 0% in July.

The CBOE Volatility Index (VIX) gives up 8.84% today at 17.65 just to confirm the risk-off market mood.

Nasdaq getting a boost from Nutanix +29.74%, Shoe Carnival +21.23%, Tech Data +17.88 and Matrix Service +15.18%. On the other hand, Nasdaq dragged down by Ollie’s Bargain Outlet -24.44 and So-Young -19.25.

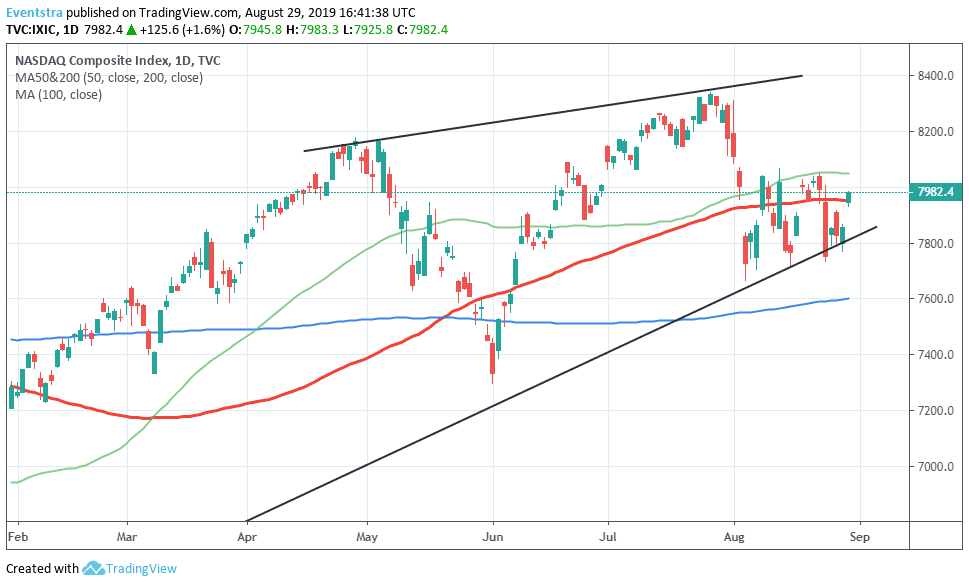

Nasdaq breaks above the 100-day moving average and bulls are back in the game. On the upside, immediate resistance is at 7,980 the daily high and then at 8,049 the 200-day moving average. On the downside, immediate support stands at 7,925 today’s low, while more bids will emerge at 7,812 the low band of the ascending channel. Traders looking to enter long positions can buy if the index manages to close above today’s high, targeting a break above 8,000 mark for profits, and can keep their long positions as far the index is trading above the 7,900 mark. A short position might be initiated if the index breaks below the 100 day moving average at 7,953. The technical analysis suggests a near-term “neutral” to bullish outlook for Nasdaq.

The European Indices finished higher, the FTSE 100 ended 0.98 per cent higher at 7,184 as the pound trades at 1.2201. DAX 30 finished 1.18 percent higher at 11,838 while CAC 40 in Paris registered +1.52 percent at 5,449.

Nasdaq Breaks Above the 100 Day MA

Nasdaq Breaks Above the 100 Day MA