- Summary:

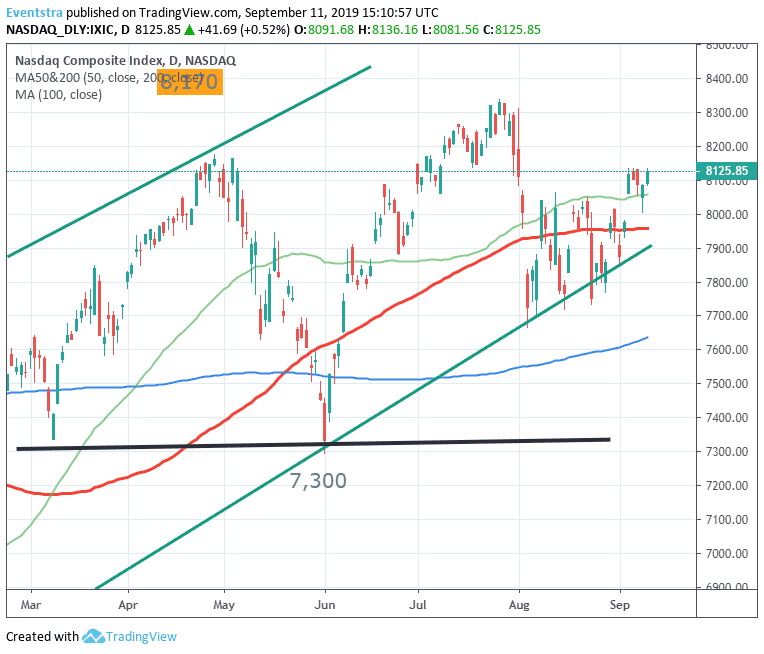

- Nasdaq bullish momentum is intact as the index is trading above all major daily moving averages. On the upside immediate resistance stands at 8,136

Nasdaq started higher today, adding 0.59% at 8,131 after China said will exempt some American products from tariff increases; investors focus turn to central banks measures to support economic growth. Analyst’s expect the ECB to cut interest rates by 20 bps on Thursday. The Nasdaq is 22.29% higher year to date.

The Dow Jones Industrial Average is 0.19% higher at 26,965, while the S&P 500 trading 0.27% higher at 2,987.44. The CBOE Volatility Index (VIX) is giving up 1.84% today at 14.93 to confirm a positive market mood.

Nasdaq bullish momentum is intact as the index is trading above all major daily moving averages. On the upside immediate resistance stands at 8,136 the daily high and then at 8,310 the high from August 1st. On the downside immediate support stands at 8,081 today’s low, while more bids will emerge at 7,882 the low band of the ascending channel. Traders looking to enter long positions can buy if the index manages to close above today’s high (8,136), targeting a break above 8,500 mark for profits, and can keep their long positions as far the index is trading above the 8,000 mark. A short position might be initiated if the index breaks below the 100 day moving average at 7,959. The technical analysis suggests a near-term bullish outlook for Nasdaq.

The European Indices trading mixed, the FTSE 100 is 0.94 percent higher at 7,336 as the pound trades at 1.2346. DAX 30 is 0.70 percent higher at 12,354 while CAC 40 in Paris is 0.41 percent higher at 5,616.