- Summary:

- The Nasdaq 100 index is down sharply for a 6th day in a row ahead of the Fed meeting, with heightened rate hike expectations.

The Nasdaq 100 index is down 2.69% as of writing this Monday, and looks on course for a 6th day of steep losses as the market shift towards risk aversion ahead of Wednesday’s Fed meeting.

Shares of Microstrategy, the Bitcoin-heavy hedge fund plunged 14.27% on Monday after the collapse of Bitcoin prices wiped off hundreds of millions of dollars from its portfolio. The stock is now at 2-year lows. This selloff was also accompanied by mass selling in tech stocks such as Meta Platforms (formerly Facebook), which fell 3.6% and Amazon, which fell 3.31%. These stocks suffered heavy selling on Thursday and Friday last week as the expectation of interest rate hikes in the US heighten.

Nasdaq 100 Index Outlook

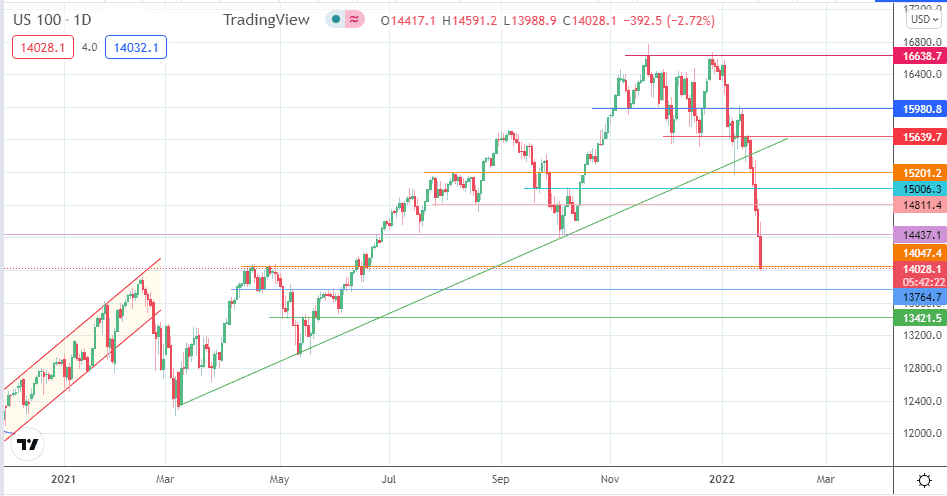

The intraday decline is now testing the previous 16 April/28 April 2021 double top at 14047. If the bears crush this support level, there will be a clear path towards the next support formed by the double top’s neckline and the 10 May/1 June highs at 13764. The 4 May 2021 low at 13421 forms an additional target to the south.

On the flip side, a bounce on 14047 gives a chance for price recovery at 14437. Above this level, 14811 and 15006 form additional barriers to the north, with the 10 January low at 15201 also forming an additional resistance.

Nasdaq 100: Daily Chart

Follow Eno on Twitter.