- Nasdaq 100 index closed yesterday's trading session with a gain of 299.49 points gain. This was a 2.15 per cent increase.

Nasdaq 100 index closed yesterday’s trading session with a gain of 299.49 points gain. This was a 2.15 per cent increase. However, though we are still in its first hours, today’s trading session has shown a strong bearish and is likely to close below the opening price. Currently, the index has already decreased by 60 points, which is over 0.5 per cent.

The drop is also likely to continue, and the markets may drop further, considering we are still in the early stages of the session. The current Nasdaq 100 index rebound was also seen in other indices such as the Dow Jones and S&P 500, which recorded over a percentage gain in Tuesday’s trading session.

However, yesterday’s growth also came amidst reports that showed some of the tech companies listed in the market losing. This included the biggest loser of the day, which happened to be Netflix, which dropped by more than 25 per cent after it released its earnings reports showing it was struggling in the markets.

Nasdaq index 100 has also struggled in 2022 to keep up with the 2021 pace. In fact, the index has lost 13 per cent of its value since the year started. The index also looks unlikely to meet 2021 gains, where the index rose by over 25 per cent.

However, many experts are still optimistic that a resurgence is still possible. Financial Express, for instance, wrote a report with a detailed view of how the Nasdaq 100 index has struggled. However, they pointed out that it is likely that the prices will rebound, giving reasons on why not to count the technology sector out.

Nasdaq 100 Index Prediction

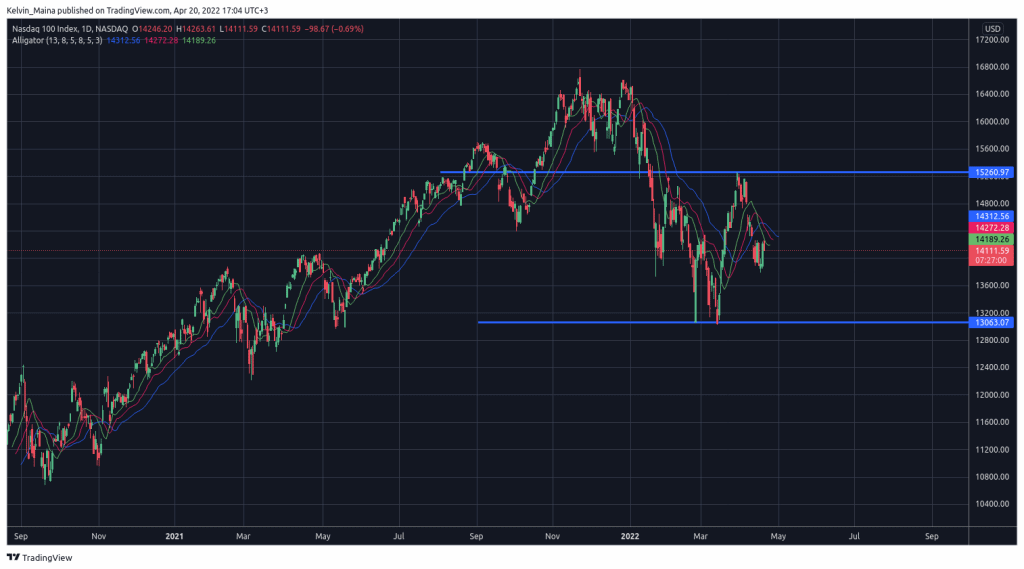

Today’s Nasdaq 100 index is looking very bearish, and although we are still early into the session, there is a likelihood of the bearish trend continuing. Therefore, my Nasdaq 100 index prediction expects it continues with the current drop. In addition, there is a high likelihood of the index trading below 13000 points in the coming days. This means I expect it to hit the recent support levels of 13063 points and break downwards.

Nasdaq 100 Daily Chart