- Summary:

- The Nasdaq 100 index futures are trading slightly higher ahead of Thursday's market open, as positive US data continues to carry the market.

The Nasdaq 100 index gained massively on Wednesday after Factory Orders and the ISM Services PMI for July 2022 came in better than expected.

Data released by the Institute of Supply Management showed an improvement in business conditions in the US services sector, with the PMI rising from 55.3 in June to 56.7 in July. This figure also beat the market’s expectations, which had predicted a drop to 53.5. The Census Bureau’s Factory Orders report also showed a rise of 2.0% in July 2022, beating the previous and consensus numbers of 1.8% and 1.3%, respectively.

Positive earnings by several Nasdaq-listed companies are also pushing bullish sentiment. Biotech companies Moderna and Regeneron posted earnings of $5.24 and $9.77 per share, beating the respective estimates of $4.50 and $8.53.

The Nasdaq 100 index may have a quieter day after gaining 2.54% on Wednesday. The Nasdaq 100 index futures are presently up 0.24% in the premarket. The last major trigger for the week comes on Friday, when the Non-Farm Payrolls report is released. The market expectation is for the unemployment rate to remain static at 3.6% and for the US public sector to see a slight slowing of hiring from 372K to 250K.

The Nasdaq 100 index has gained 16.4% since mid-June and continues its upward trajectory of recovery after last week’s Fed decision stoked dovish expectations. A further advance will see the Nasdaq 100 index push out of bear territory.

Nasdaq 100 Index Forecast

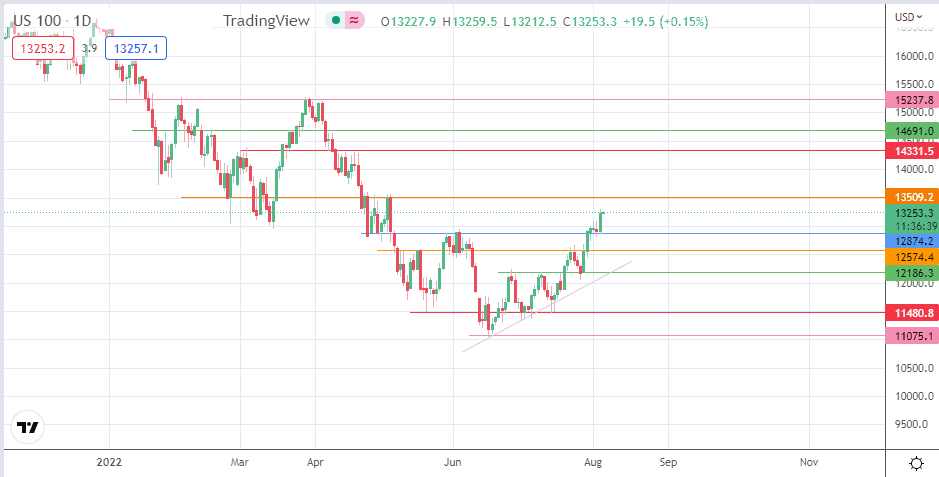

The bounce on the 12874 support keeps the index on course to attain the 13509 resistance (28 April and 5 May highs). A break of this level targets 14331 (1 March high/7 April low) before the 15237 price barrier formed by the 2 February and 29 March highs comes into the picture as a new upside target.

On the other hand, the bears would need to see a breakdown of the 12874 and 12574 (11/18 May highs and 8 June low), as well as a closing penetration of 3% or more below the 12186 pivot (27 July low) to clear the way to new downside targets. This move also breaks down the ascending trendline that connects the June/July lows, targeting 11480 (20 May and 14 July lows). A breach of this support brings 11075 into the mix, being the previous low of 16 June 2022. A breakdown of this level allows the downtrend to continue, with the 28 July 2020 low at 10500 lining up as the next target to the south.

US100: Daily Chart