- The Nasdaq 100 index has gotten extremely vulnerable as some of its biggest constituents like Apple, Microsoft, and Tesla keep sliding

The Nasdaq 100 index has gotten extremely vulnerable as some of its biggest constituents like Apple, Microsoft, and Tesla keep sliding. The NDX is trading at $11,769, which is about 30% below the highest point in 2021. With more downside expected, there are questions about whether the tech bubble has already burst.

Tech bubble 2.0

The Nasdaq 100 index is concealing a very ugly situation even after it has crashed by 30% from its highest point in 2021. While this is a tragic decline, the reality is that it has been supported by the performance of large tech companies like Google, Apple, and Microsoft.

Google shares have fallen by about 30% while Apple and Microsoft stock prices have fallen by 22% and 25% from their highs. While these are large declines, they are substantially better than what other companies have performed.

For example, the Facebook stock price has plummeted by 52% while Snap has collapsed by over 75%. Other companies like Carvana, Pinterest, Wayfair, Roku, Stitch Fix, Oscar Health, Affirm, Roku, Unity Software, and Asana have all fallen by more than 70% from their all-time highs.

To put this into perspective, Carvana stock price was trading at almost $400 in 2021. Today, it is at $26. Similarly, Wayfair was trading at $350 and now is sitting at $45. Other Nasdaq 100 companies that have dropped hard include Shopify, Arqit Quantum, Monday.com, and Roblox.

A good way to see why this Tech bubble 2.0 has burst is to consider the performance of Cathie Wood’s the Ark Innovation Fund, which has plummeted by more than 67%. This performance has happened as investors have dumped high-risk companies because of the extremely hawkish Federal Reserve.

Nasdaq 100 index forecast

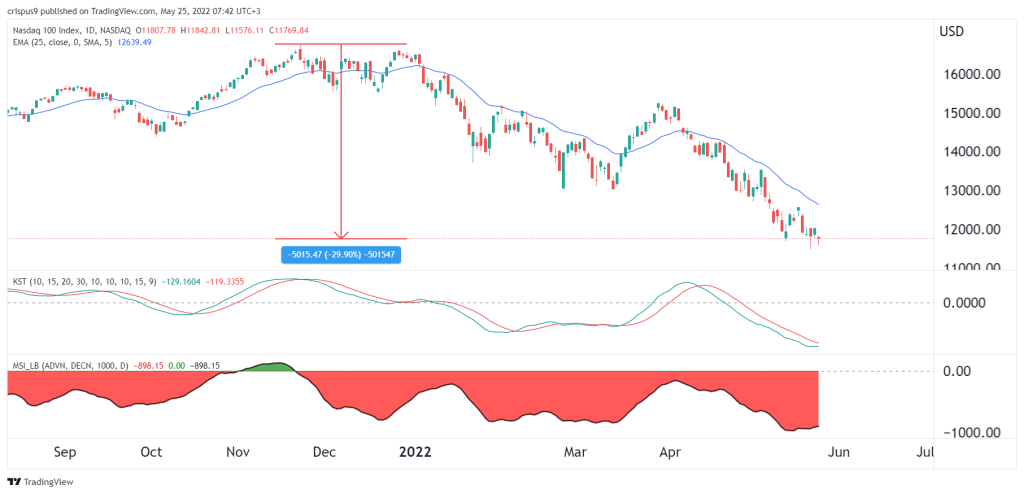

In my last note, I made the case for selling in May and going away. Turning to the daily chart, we see that the Nasdaq 100 index has been in a spectacular downward trend in the past few months. All up days have been met with sharp declines. The sell-off is being supported by the 25-day and 50-day moving averages. At the same time, the McClellan Summation Index has moved below the neutral level, signaling that there are more stocks in the red. The Know Sure Thing has also moved downwards.

Therefore, the Nasdaq index will likely continue falling in the near term as the situation gets worse by the day. As such, a bottoming is not near and there is a possibility that the index will tumble to about $10,000. A move above the resistance level at $12,500 will invalidate the bearish view.