- The Nasdaq 100 index has recovered modestly in the past few days as the market volatility cools. The index is trading at $13,956

The Nasdaq 100 index has recovered modestly in the past few days as the market volatility cools. The index is trading at $13,956, which is about 7% above the lowest level this year. Similarly, the Invesco QQQ stock price has risen by a similar amount although it remains about 16.2% below the highest level this year.

VIX index retreats

The Nasdaq 100 index jumped on Wednesday after signs emerged that Ukraine and Russia were making progress in their negotiations. According to the Financial Times, the negotiating teams have identified 15 points as part of the deal. And in a statement on Wednesday, Sergey Lavrov said that he believed that the two sides could reach an agreement in the next few days.

A deal will be positive for Nasdaq 10, S&P 500, and Dow Jones because it will provide an end to the crisis. The longer the crisis continues the worse it will be for American stocks because of the rising cost of doing business. As a result, the CBOE VIX index has declined sharply in the past few days and is trading at $26. The fear and greed index, on the other hand, is still at the extreme fear zone.

The Nasdaq index also rebounded even after the Federal Reserve delivered its first interest rate hike since 2018. It also hinted that it will hike rates in all the remaining meetings of the year. The index rose because the Fed decision was already priced in by investors.

Has the tech bubble burst?

The main concern among investors is whether the technology bubble has burst. That’s because most technology companies that did well in the past few years have all declined sharply. For example, the Oracle stock price has crashed by over 22% in the past 3 months. Similarly, PayPal shares have dropped by more than 56% in the past 12 months. As a result, its total market cap has dropped from over 300 billion to about $125 billion.

It is not alone. The Block stock price has dropped by over 52% in the past year, bringing its market cap to about 67%. This is notable since the company recently bought Afterpay in a $29 billion deal. Other tech companies that signify the bursting of the industry are Teladoc, Roku, Meta, and Zoom Video. As interest rates rise, the situation will likely get worse.

Nasdaq 100 index forecast

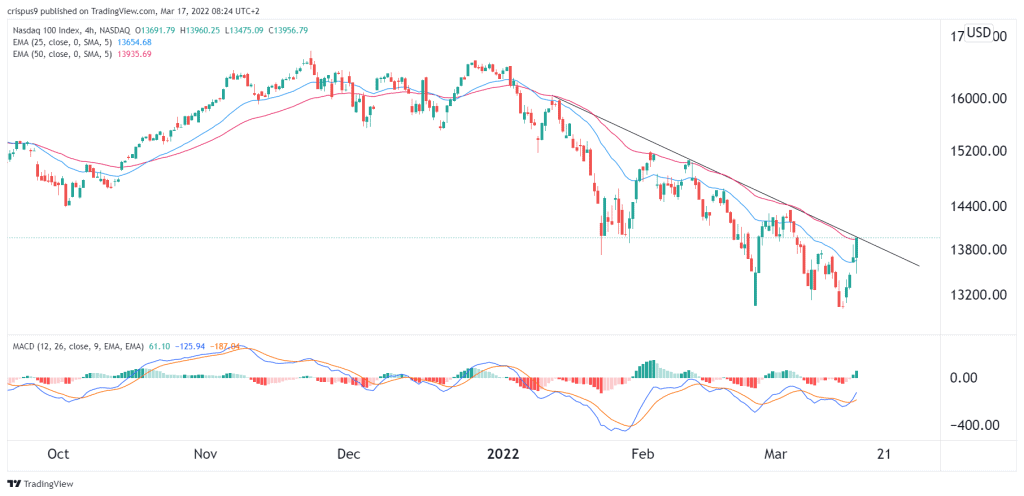

The four-hour chart shows that the Nasdaq index declined sharply in the past few days. While this is a positive situation, the reality is that the index remains below the descending trendline shown in black. It has not yet cleared the 25-day and 50-day moving averages. Therefore, there is a likelihood that this is a dead cat bounce, meaning that the index will resume the downward trend in the near term. The bearish trend will continue as long as the index is below the descending trendline.