- Summary:

- The Nasdaq 100 bullish momentum has continued in the past few weeks as sign of greed appear in the market. What next?

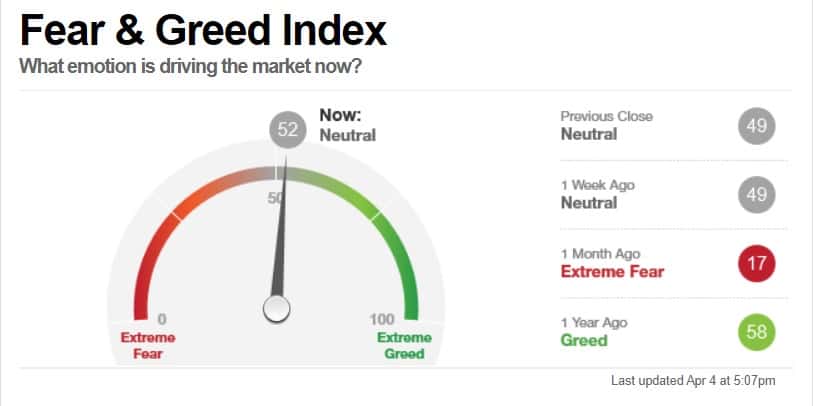

The Nasdaq 100 bullish momentum has continued as signs of greed appear in the market in the past few weeks. The index is trading at $15,160, about 16.2% above the lowest level this year. It has done well as the fear and greed index has moved from below 20 to52. In addition, Nasdaq ETFs like Invesco QQQ and ProShares UltraPro QQQ (TQQQ) have rallied.

Nasdaq 100 overview

Technology stocks were among the worst performers in the first quarter as rotation from value to growth continued. This rotation happened as investors braced for a more hawkish Federal Reserve. The bank decided to start hiking interest rates in Q1, and there are signs that it will be more aggressive in the coming months. Most officials like Mary Daly have hinted that they will prefer a 0.50% rate hike in the coming meeting in May.

Tech stocks in the Nasdaq 100 and QQQ also struggled as a rotation from lockdown to reopening stocks continued. As a result, tech companies that did well during the pandemic underperformed in the first part of the quarter. Instead, they were mostly focused on companies expected to do well as the economy recovers.

The best performers in the Nasdaq index were Splunk, Vertex, Activision Blizzard, Palo Alto Networks, and CrowdStrike. Activision shares rose after the acquisition offer from Microsoft, while demand for cybersecurity pushed CrowdStrike and Palo Alto Networks higher. Other top performers in the index were Tesla, Sirius XM, and America Express.

On the other hand, the main laggards in Q1 were companies like PayPal, Netflix, Lucid Group, Moderna, Meta Platforms, Okta, and DocuSign. All these shares have crashed by over 26% in Q1. Other laggards were Starbucks, ZScaler, and Intuit.

Nasdaq 100 forecast

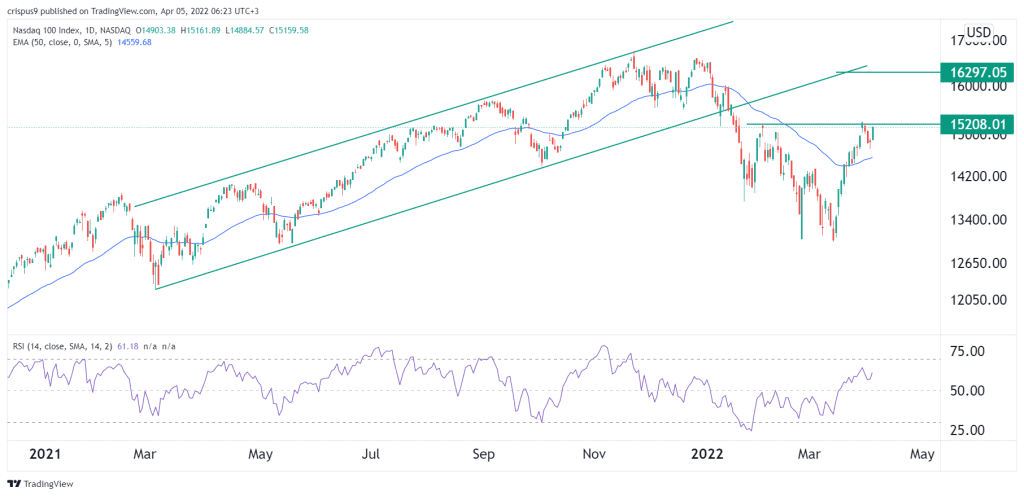

A quick look at the daily chart shows that the Nasdaq index was in a strong bullish trend for months. At the time, the index formed an ascending channel shown in green. It moved below the lower line of this channel on January 21st. Now, the Nasdaq 100 index is attempting to move back to this ascending channel. It has also moved above the 50-day exponential moving average (EMA), while the Relative Strength Index has moved above 60.

Therefore, the index will likely keep rising as bulls attempt to retest the lower side of the ascending channel at around $16,300. A drop below $14,200 will invalidate this view.