- Summary:

- The Nasdaq 100 index pulled back slightly as focus shifted on the upcoming US consumer inflation (CPI) data. What next for the index?

The Nasdaq 100 index pulled back slightly as focus shifted to the upcoming US consumer inflation (CPI) data. The tech-heavy index crashed to a low of $13,036, which was lower than this year’s high of $13,347. This price is about 18% above the lowest point this year. Other US indices like the Russell 2000 and Dow Jones have also retreated.

US inflation data ahead

The Nasdaq 100 index has been in a strong bullish trend in the past few days as investors buy the dip. The rebound continued after last Friday’s release of strong jobs numbers from the United States. The numbers revealed that the economy added over 528k jobs in July while the unemployment rate slipped to 3.5% during the month.

Focus now shifts to the latest American inflation data that is scheduled for Wednesday. Economists expect the data to reveal that the country’s inflation declined slightly in July as the prices of gasoline eased. Precisely, they expect that inflation dropped from 9.1% to 8.7%.

The Nasdaq 100 index has also reacted to the ongoing earnings season. This week, companies like Palantir Technologies’ stock price crashed hard after the company published weak quarterly results. Meanwhile, Coinbase share price crashed after the company announced a $1.9 billion loss. Finally, Roblox stock eased by 20% after booking worse-than-expected results.

Meanwhile, shares of Unity Software popped after AppLovin proposed a $17.5 billion to acquire Unity Software. The next key Nasdaq 100 stocks to publish their results are Paysafe Limited, Fox corporation, Veru, and Bumble, among others.

Nasdaq 100 forecast

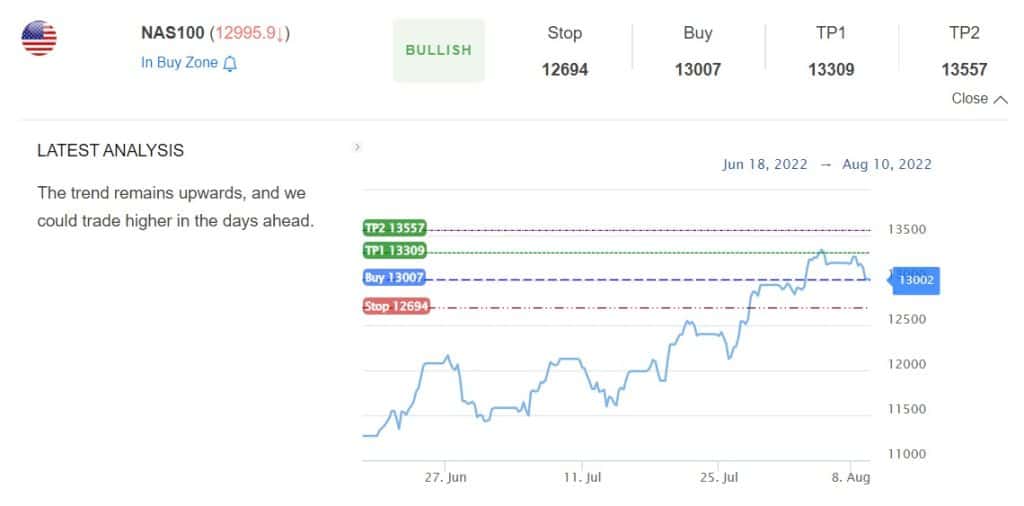

The chart shows that the Nasdaq 100 index has been in a strong bullish trend in the past few weeks. The 25-day and 50-day moving averages have supported this rally. However, the shares have done a break and retest pattern by moving back to $12,876, which was the highest level on June 2nd.

Therefore, the index will likely continue rising in the foreseeable future. According to Investing Cube’s S&R indicator, the next key resistance points to watch will be at $13,309 and $13,557. On the other hand, a drop below $12,695 will invalidate the bullish view.