- Summary:

- Nasdaq 100 correction took many by surprise as Tesla lost one fifth of its market capitalization in only one trading day. Here is a bullish scenario.

Nasdaq 100 put pressure on bulls yesterday as it delivered a correction that scared many. As it is often the case with stock market traders, everyone wishes for a market pullback to enter the trend. But then, when the pullback eventually comes, most traders are too afraid to go in. Will this time be different?

Tesla Leading the Bearish Slide

Tesla lost over one-fifth of its market capitalization in one single trading day. Yesterday marked the biggest market drop in the share’s history. However, it depends a lot on how you want to interpret things.

One way is to focus on yesterday’s drop. After all, it led Nasdaq 100 lower. But another way is to look at the bright side of things. Tesla is up over 600% this year so far, and this makes the current Nasdaq 100 move lower, just a simple correction.

Tech Stocks Correcting

It was not only Tesla that sent Nasdaq lower. No less than seven U.S. tech stocks declined so aggressively that in the last three days, they shed over $1 trillion in market capitalization.

Nasdaq’s drop of 10% may be considered an opportunity for bulls waiting for a correction. At this point, the focus shifts on the USD and the Fed.

As long as the Fed sustains a lower USD policy, the stock market is poised to rebound. For this, technical analysis helps in identifying suitable entry levels.

Nasdaq 100 Technical Analysis

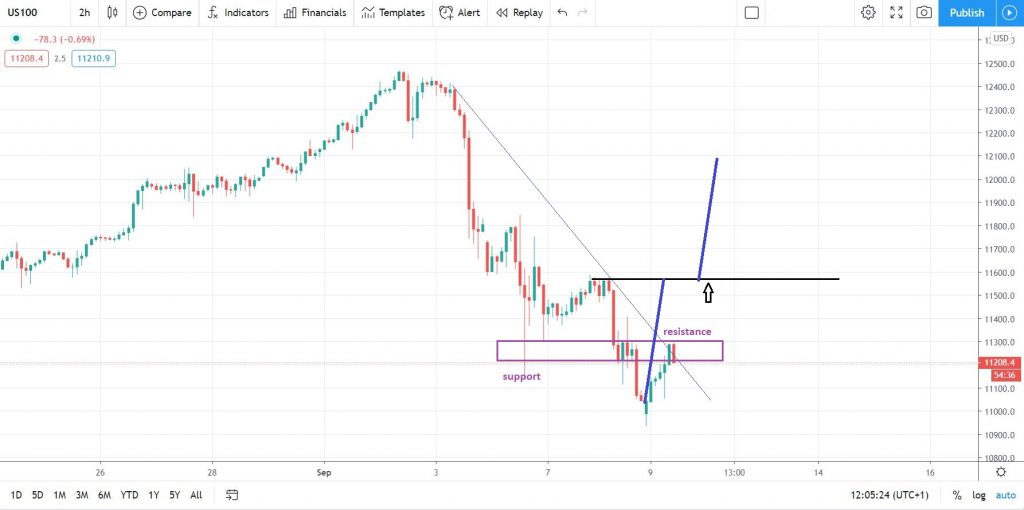

Nasdaq broke support and now support turned into resistance. However, trading it at market on the long side is risky because the series of lower highs is not broken.

Therefore, bulls may want to wait for the price to bounce back to the previous consolidation area, before going long. This is 11,600. Next, a stop-loss at 11,100 is mandatory for the bullish scenario, while targeting new all-time highs.

To learn how to trade indices, consider our trading coaching program.

Nasdaq 100 Price Forecast