- Summary:

- Demand for the Japanese Yen is surging as protests in Hong Kong spill over to the international airport, stopping all internatonal flights.

The Japanese Yen has continued to witness increasing safe haven demand amid news of an increasing standoff between protesters and the authorities in Hong Kong. According to reports, protesters have thronged the international airport in a renewed wave of pro-democracy protests, prompting the authorities to cancel all outgoing flights from the airport.

In response to this escalation, it is reported by the Chinese Global Times that the People’s Police has begun to amass personnel at the border town of Shenzhen, possibly to forestall a breakdown of law and order.

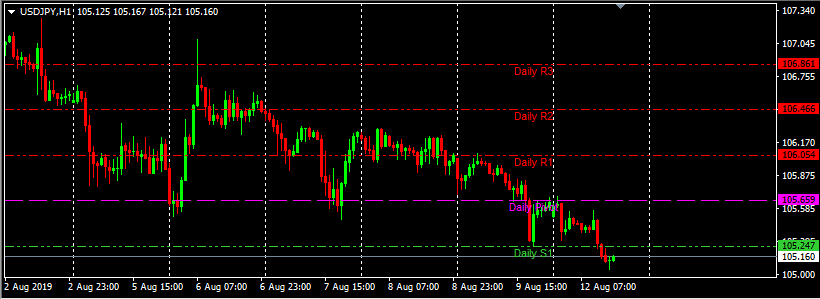

The current situation will only add to the safe haven plays on the USD/JPY, which is presently trading at 7-month lows of 105.11, pushing it below the S1 pivot of 105.24. The US-China trade war continues to play a major role on the USDJPY’s price action, after U.S. President Donald Trump said that Washington was not going to cut a deal with Beijing for now even though talks would continue.

Immediate resistance lies at 105.22. A break above this level will target the next resistance at 105.65. To the downside, the USDJPY is expected to test the S2 pivot support of 104.83. A downside break of this area could take it down to 104.40 if downside momentum persists.