- Summary:

- The MGM stock price looks set to extend the slump as casino stocks take a massive hit from the proposed new Macau gaming regulations

The MGM stock price for the ADR listed equity on the New York Stock Exchange is set for a lower open, following its Hong Kong-listed counterpart lower as the onslaught on casino stocks continue. Gaming stocks listed on the Hong Kong stock exchange have had to endure some tremendous losses this week as new regulations from Beijing sent the casino and gaming industry in Macau into turmoil.

MGM stock price is also affected, as the company has some exposure in Macau.

Stocks of casino companies operating in Macau have been facing significant headwinds from the pandemic. A shutdown of international travel and restrictions on gatherings at recreational centres have kept tourists and gamers away from the territory. Chinese officials said they would appoint government supervisors to oversee the operations of gaming companies in Macau as part of a broader range of new regulations proposed for the industry, sending gaming stocks reeling and wiping off an estimated $14billion in the combined market capitalization.

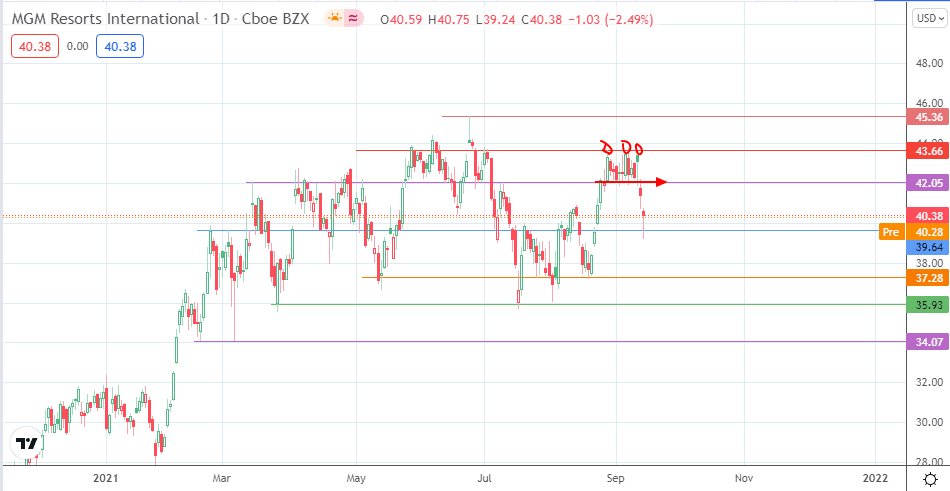

The MGM stock price is trading at 40.28 in the premarket, down 10 cents from Wednesday’s closing price as of writing.

MGM Stock Price Prediction

The decline from the completion of the triple top pattern puts the 39.64 price mark on the pathway to a stiff test from the bears. If this support capitulates, 37.28 becomes the next available pivot. If the decline is more extensive, it will be hard to rule out a run towards 35.93 or 34.087.

On the flip side, bulls need the 39.64 support to hold out, with a bounce providing a chance for a retest of the 42.05 price mark, which is the previous neckline of the triple top. If the bulls overcome this level, the previous triple tops at 43.66 may face a test. The uptrend resumes only when the price breaks past this level and the 24 June high at 45.36.

MGM Stock Price (Daily)

Follow Eno on Twitter.