- Summary:

- META stock price outlook remains bullish as the price is gaining strength after Q3 earnings report. It needs to hold $307 level.

Meta stock price has had a tremendous year as the Facebook parent experienced unprecedented growth of over 175% in 2023. However, the stock opened the Friday trading session in the red after it broke above the middle of the $288-$326 price range earlier this week.

US stocks have been rising amid FED’s decision to maintain the interest rates between 5.25%-5.5% range which was in line with expectations. Additionally, the weak job data released today has reduced prospects for another rate hike in the future and has thus resulted in Wall Street indices opening in the green for the fifth consecutive day.

Meta’s Q3 earnings contributed significantly to its 10.6% gain from last week’s low. The tech giant earned $34.1 billion in revenue while also reporting a 7% decline in its expenses. As a result, Meta announced a $4.39 earnings per share, up from $1.64 per share.

The Facebook parent has found itself in hot waters after the platform risks a ban in over 30 countries under the European Economic Area. This harsh move comes due to Meta being accused of using personal data for behavioral advertising.

Consequently, the lead supervisor authority, IPDC, has announced that it expects to ban Meta’s services in less than one week.

Meta Stock Price Forecast

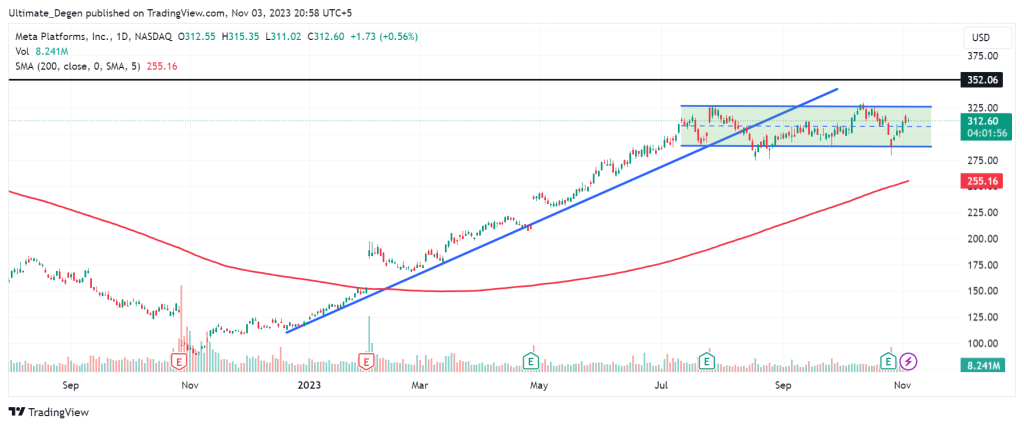

As mentioned in my previous analysis, NASDAQ: META has been trading inside the $288-$326 price range since July 2023. Currently, the stock is trading 2.2% above $307 which is the middle of the range which puts the retest of $326 on the cards in the coming days.

Meta stock price forecast will remain bullish until the price breaks below the $288 level. Therefore, if the price loses its $307 support, I expect a rest of the $288 range lows. A plunge below $288 will likely open the gates for a retest of the 200 MA which lies at $255.