- Summary:

- The Marks and Spencer share price declined by over 8% on Thursday even after the company published a strong forward guidance

The Marks and Spencer share price declined by over 8% on Thursday even after the company published a strong forward guidance. The MKS shares are trading at 233p, which is about 11% below the highest level this year. Other retail stocks like Tesco and Sainsbury’s have struggled this year.

Marks and Spencer had a strong holiday season even as the country continued battling the omicron variant of coronavirus. The company said that it will likely beat its previous forward guidance, helped by the record sales of food and groceries. It expects that its profit will rise to 500 pounds as food sales rose by about 12%.

The MKS share price probably decline because the company warned about its future growth and the impact of inflation on its business. It also declined after changing the name of its Midget Gems after claims emerged that the name was offensive to people with dwarfism. The shares have doubled in the past 12 months on hopes that the company could be acquired.

Marks and Spencer share price forecast

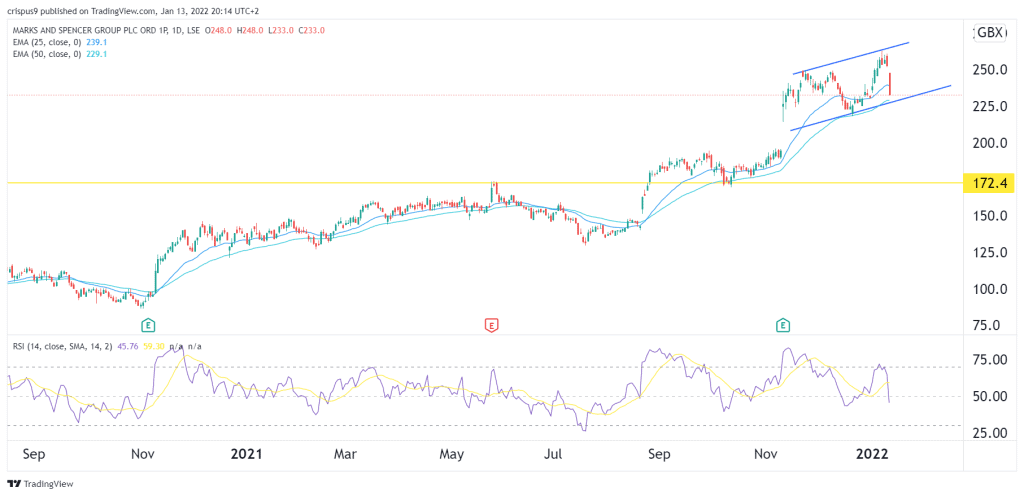

The daily chart shows that the Marks and Spencer share price has been in a strong bullish trend in the past few months. Subsequently, the shares have managed to move above the 25-day and 50-day exponential moving averages (EMA).

A closer look shows that the stock has formed an ascending channel that is shown in blue. The stock is currently slightly above the lower side of the channel. The Relative Strength Index (RSI) has also pointed lower.

Therefore, the stock will likely continue falling as investors attempt to fill the gap that was formed on November 10th. The alternative scenario is where the stock rises to retest the upper side of the channel.