- Summary:

- The Decentraland platform continues to gain traction, which is translating to Mana prices rising and is up by one per cent.

The Decentraland platform continues to gain traction, translating to Mana prices rising. The cryptocurrency is up by almost a percentage point in today’s trading session. The prices are also showing signs of a new bullish move, despite trading sideways for more than a week.

Although the current long-term trend of the cryptocurrency is strongly bearish, Decentraland has had strong fundamentals for the past few days. This includes the latest announcement by Fidelity about their immersive educational metaverse experience. The firm becomes the first brokerage to invest in Decentraland.

According to reports, the metaverse will help Fidelity users to learn investing basics. The move by Fidelity is one of the creative ways they are reaching their customer’s needs, especially the technologically savvy clients. The move is a clear indication of the Decentraland metaverse and how useful it is going to be in the future. The move is also likely to push Mana prices up and resume the bullish trend.

Looking at the past 24 hours’ data, the cryptocurrency has fallen by more than 4 per cent, despite gaining in today’s trading session. The data also shows a 10 per cent drop in the trading volume of the cryptocurrency. This has brought the total trading volume of the cryptocurrency to about 275 million. A decline in trading volume can sometimes translate to cryptocurrency market prices and result in a drop.

Mana Price Prediction

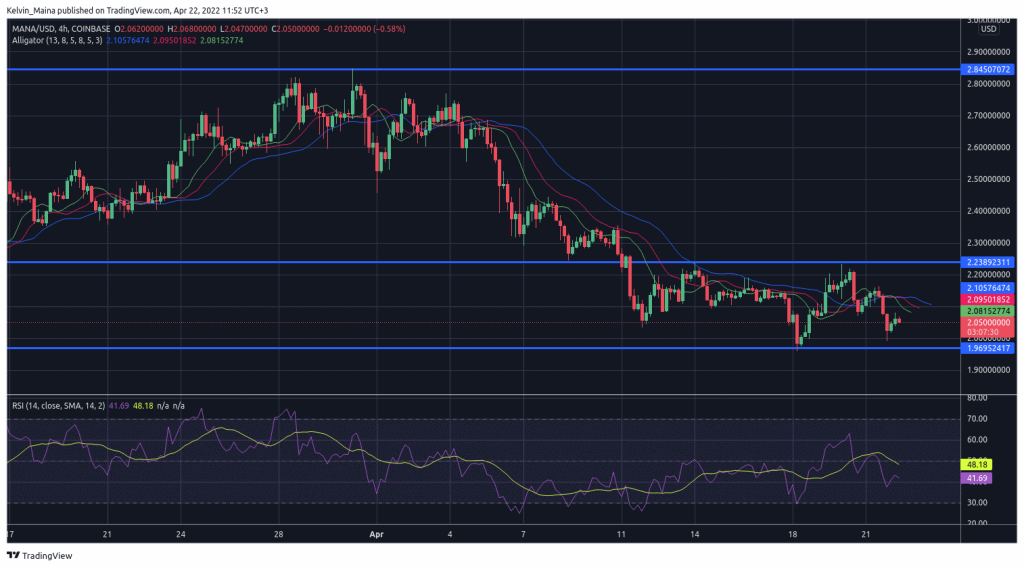

The 4-hour chart below shows the prices have traded within support and resistance levels of 1.96 and 2.23, respectively, for more than a week. The chart also shows that the current prices look like they are in a sideways market. However, in today’s trading session, the prices are looking very bullish, resulting in an almost one per cent price increase for the cryptocurrency.

Using the below, I expect the Mana price to continue growing in the next few days. However, there is also a high likelihood of the prices moving towards the $2.23 resistance level and testing it. If the prices will have high volatility after hitting the resistance level, there is also a high likelihood of the prices trading above it. This is likely to result in prices trading above the $2.3 price level.

Mana 4-Hour Chart