- Summary:

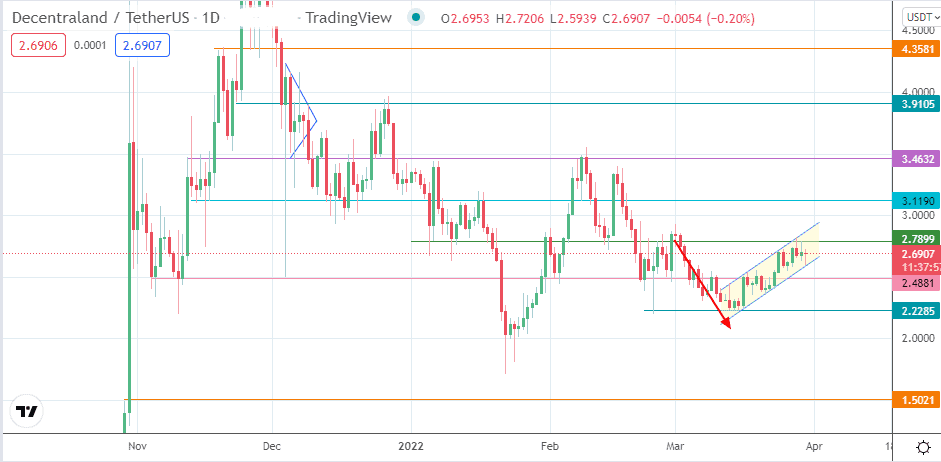

- Waning buying momentum and the bearish flag pattern points towards the 2.22 price support as an immediate target.

The weakening of bullish momentum on the pairing of Decentraland and Tether could give rise to bearish MANA price predictions in the short term. However, the daily chart shows that the daily volumes of the candles attempting a break of the key resistance at 2.7899 are shrinking.

The latest price action is trading in a rising channel consolidation zone, which can be seen as the flag portion of the bearish flag pattern. The expected resolution of this pattern is for a breakdown of the flag’s lower border. This expectation requires the bears to reject the price activity once more at the 2.7899 resistance, following two previous failed attempts to break this barrier in a northbound direction.

The recent Decentraland Metaverse fashion week should have added some spice to the price action on the MANA/USDT pair. Guess what? It did not happen. But with Morgan Stanley estimating Web 3.0 revenue opportunities in the luxury and fashion industries to hit $50billion by 2030, there could be a long-term opportunity for projects like Decentraland. This could add value to HODLers, but for the moment, the attention of the market is elsewhere.

MANA Price Prediction

The 2.7899 price resistance (25 February and 28 March highs) is the level to beat for the bulls. If the bulls can uncap this resistance, buyers will have clear skies to target the 3.1190 price level (8 January high and 8 February low). Above this level, the 8 February peak at 3.4632 serves as an additional northbound target.

On the flip side, a failure of the bulls to break the 2.7899 price resistance could lead to a decline that targets 2.4881 (11 November 2021 and 2/28 February 2022 lows). The completion of the bearish flag pattern points to a downside measured move that terminates at 2.2285.

Therefore, the price support at 2.4881 must be degraded to accomplish this measured move. The 2.000 psychological price level is where the 23 January 2022 trough lies, and this pivot awaits the bears if they take the price activity beyond the bearish flag’s measured move.

Decentraland: Daily Chart