- Summary:

- Our Loopring price prediction appears to be quite bullish as Gamestop NFT marketplace just went live on Loopring.

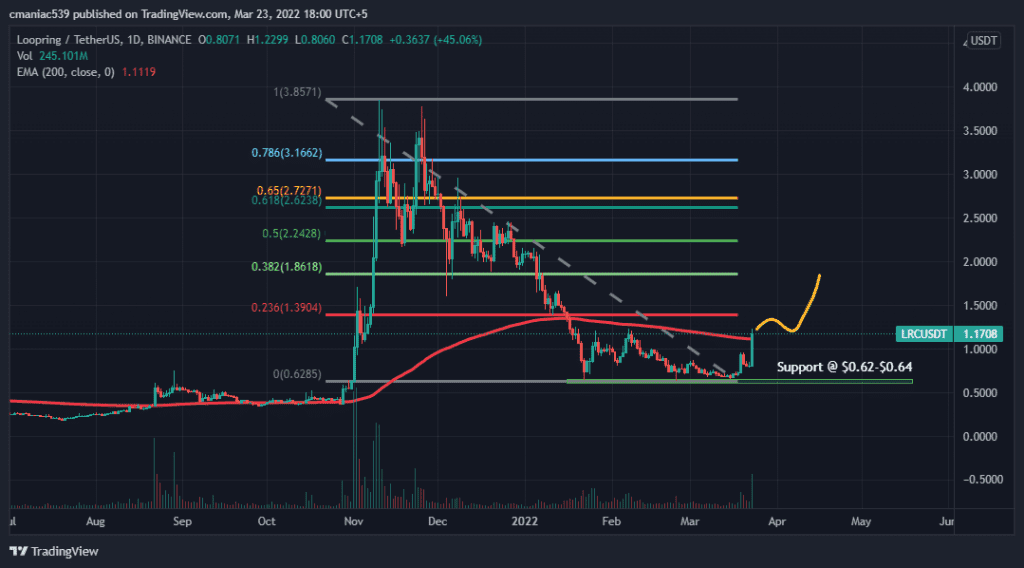

Our Loopring price prediction appears to be quite bullish as the LRC-USD price chart appears to have reversed. Loopring crypto price has surged by almost 50% in a single day, signaling a bullish reversal. The price action occurred after the recent announcement of the Loopring GameStop partnership. At the time of writing, LRC crypto is trading at $1.19.

Latest Loopring News

As per the latest Loopring news today, the GameStop NFT marketplace has gone live on L2. Several users posted screenshots of Loopring wallet integration with the new marketplace. According to the official tweet from Loopring crypto, the full version would also be rolled out soon. As per the report, the full marketplace could be live by the end of Q2 2022. This could make Loopring price prediction very bullish.

Loopring is a ZK-Rollup based Layer 2 for Ethereum. The transactions are bundled together and then finally settled on the main Ethereum network. This takes off a huge load from Ethereum while also saving its users a lot of transaction fees. As the name suggests, zero-knowledge proofs allow the determination of data accuracy without actually sharing the data.

Loopring coin with ticker LRC is the native asset of L2. DeFi Lama shows the total locked value on the Loopring network to be$395 million. However, the same figure was almost $800 million at the peak of the bull-run in November 2021.

Loopring Price Prediction

Right after the announcement about the launch of the Loopring GameStop marketplace, Loopring coin pumped from $0.80 to $1.20. At the time of writing, the LRC coin is trading at $1.19. However, the cryptocurrency is still more than 68% down from its November 2021 ATH of $3.75.

If the recent pump continues, the LRC price could hit $1.86 very soon. In the case of such a bullish reversal, $2.62 seems to be a valid Loopring price prediction for 2022. The price prediction also perfectly aligns with the 0.618 Fib retracement level.

This level comes into play by connecting the November 2021 ATH of $3.75 to the recent lows of $0.63. Nevertheless, it is better not to chase the ongoing pump as the price has already surged by almost 50%. There would also be a huge probability of long-term holders selling at current levels to grab some liquidity.

Loopring Price Chart