- Summary:

- The Loopring price has fallen sharply in the past few months. How low can the LRC token go in the coming weeks?

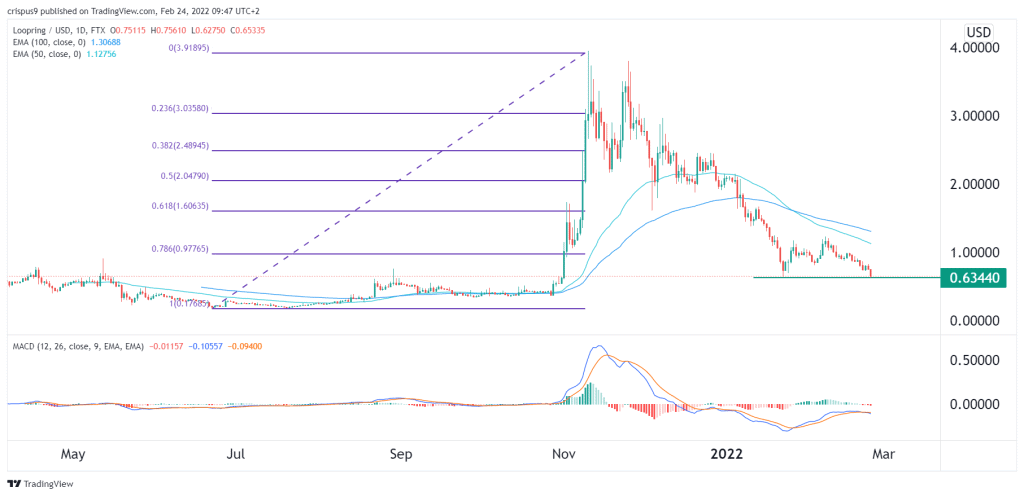

The Loopring (LRC) price has been in a major sell-off in the past few months. After soaring to an all-time high of $3.93 on November 10th, it is now trading at $0.64. That 83% drop has pushed the coin’s market capitalization to about $883 million. It is now the 97th biggest cryptocurrency in the world.

What is Loopring?

Layer 2 networks are becoming popular in the blockchain industry. Think of Polygon’s success in helping developers scale their Ethereum applications like Uniswap and Aave. Loopring is a layer 2 network that is mainly focused on payments and trading. It uses the so-called zero-knowledge (zk) rollups that help to supercharge the ecosystem. It does that by processing multiple transactions off the main Ethereum network. LRC is the native token for the ecosystem and is used to settle transactions.

The idea behind Loopring is simple. If you are a trader, you have multiple platforms where you can buy and sell coins. For example, you can use centralized exchanges like Binance and Coinbase. Alternatively, you can use decentralized options like Uniswap and PancakeSwap. The latter two are built using Ethereum and Binance Smart Chain, meaning that your transactions will incur a cost. Alternatively, you can use a zk scaling application like Loopring and save money.

Why the LRC price has fallen

There are several reasons why the Loopring price has fallen sharply in the past few months. First, it is because of the overall performance of the cryptocurrencies market. The market capitalization of all cryptocurrencies has crashed from over $3 trillion in November to about $1.6 trillion today. This means that investors have lost over $1.5 trillion in just a short period.

The weakness has been spread across all cryptocurrencies. For example, Bitcoin has moved from almost $70,000 to below $35,000. Similarly, DeFi tokens like Curve, Uniswap, and Maker have all crashed by over 70%. Second, the current sell-off is because of the rising tensions in Europe. In a televised speech on Thursday, Vladimir Putin announced that he was sending his troops to Ukraine. As a result, most assets declined sharply, with the Dow Jones shedding over 800 points.

Third, the LRC price has declined because of the rising competition in its industry. There are several layer 2 platforms like Polygon that are doing remarkably well. And finally, the overall volume of cryptocurrency trading has fallen in the past few months, as evidenced by the financial results of companies like Robinhood and Coinbase.

Loopring price forecast

On the 1D chart, we see that the LRC price has been in a deep sell-off in the past few months. The coin has managed to move below the 78.6% Fibonacci Retracement level. It has also formed a death cross pattern as the 50-day, and 200-day EMAs have made a crossover. Oscillators like the Relative Strength Index have also been falling.

Most notably, Loopring is attempting to cross the key support level at $0.644, the year-to-date low. A break below this level will likely lead to more weakness as sellers target the key support at $0.50. A move above $0.90 will invalidate this view.