The Bank of Canada today left interest rates unchanged at 1.75%. This was not a surprise, as the markets had already indicated that this would be the case through the consensus figures from analysts. This was also after a less than stellar trade balance report failed to move the Loonie as traders waited expectantly for the rate statement.

In the post-rate statement, the Bank of Canada did not provide much to suggest a dovish shift of the bank from its previous rate statement issued last month. As a result, the USDCAD pair tumbled to new session lows below the 1.3300 handle, where it is currently trading at 1.3267.

Technical Play for USDCAD

After trading in a range for most of the day, the USDCAD came to life as the BoC not only left rates unchanged, but failed to make the dovish shift that markets expected. As I indicated in my preview of this news release, such as stance would lead to Loonie strength and the play would be to sell the USDCAD.

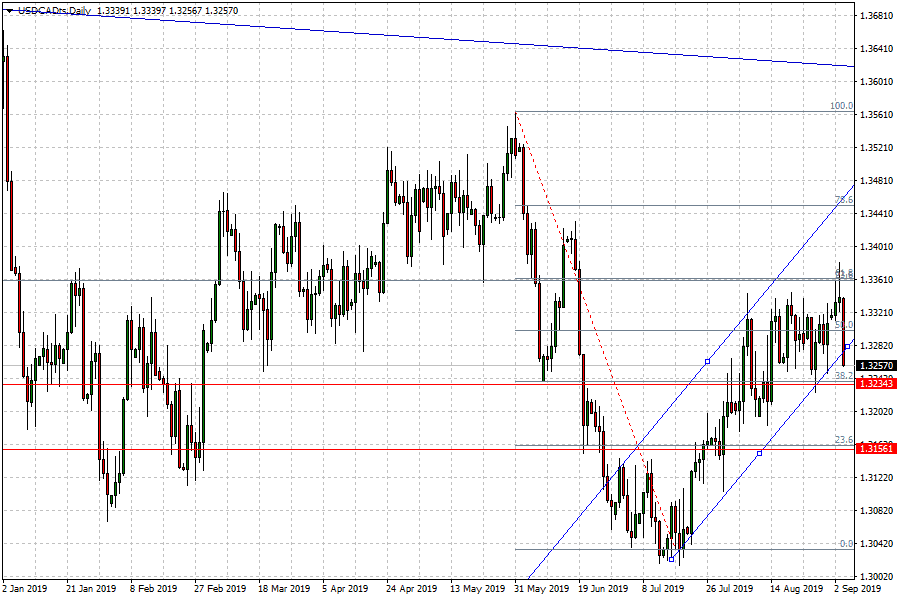

The daily chart shows that the downside price move of USDCAD is now testing the up channel on the daily chart. A 3% penetration close below the channel’s lower border could lead to further downside with 1.3234 (50% retracement level from the May 31 high to July 19 low) and 1.3156 being potential near-term price targets for swing trades.

Failure to break 1.3234 could see prices swing back upwards to retest 1.3382 (61.8% Fibonacci retracement of the previously identified swing high/low)