- Summary:

- The Lloyds share price is up this Monday, but the recovery remains unconvincing as worries over Omicron's impact remain.

Lloyds share price has made a soft bounce this Monday, after the news of the emergence of a new variant of the COVID-19 virus triggered Friday’s massive plunge. The uptick has sent the price of the stock up by 2.35%. However, the intraday bounce remains unconvincing as the markets worry about the impact of the virus on the global economy.

The mutant virus has been detected in the UK, with six new cases seen in Scotland on Monday. The situation has also reduced bets of a potential December rate hike by the Bank of England (BoE), putting downward pressure on UK bank stocks.

Lloyds Share Price Outlook

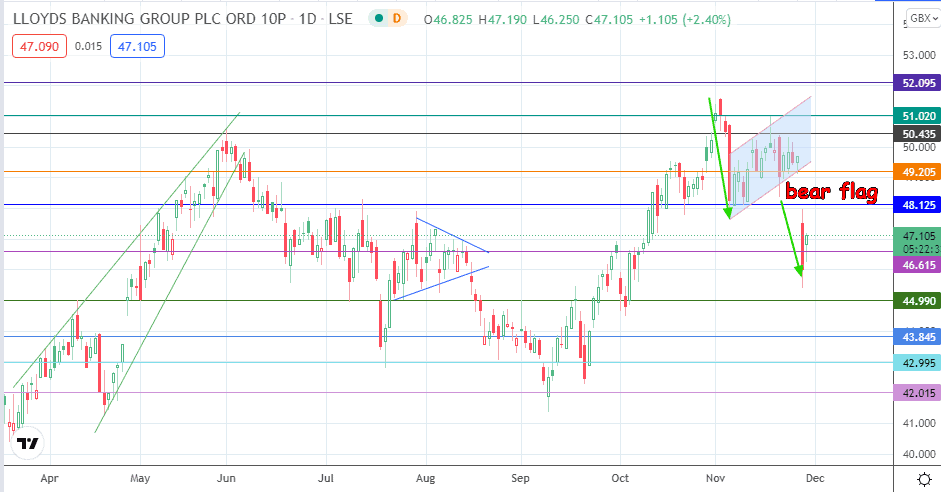

The price dip of Friday completes the corrective bearish flag on the daily chart. The Lloyds share price uptick has sent the stock above the 46.615 resistance. A closing penetration above this level opens the door for an ascent towards the 48.125 resistance. Continued recovery on the stock requires the bulls to push above 49.205 and 50.435.

On the other hand, a closing penetration below the 46.615 price mark clears the way for the price to dip further, targeting 44.90 initially. 43.845 and 42.995 are additional targets to the south, which come into view if the decline continues.

Lloyds: Daily Chart

Follow Eno on Twitter.