- Summary:

- Lloyds share price falters on the day as investors on bank stocks squirm at prospects of negative interest rates in the UK.

Lloyds share price is down on the day as markets start to ramp up bets on the possibility of a negative rate regime.

The announcement of Charlie Nunn, HSBC’s head of wealth and personal banking as the man to succeed Antonio Horta-Osorio as head of Lloyds Banking Group, did little to pacify investors, who are squirming at the thought of what a new negative rate regime would mean for the UK’s top banks.

In the meantime, the UK PM is expected to address the nation on the UK’s national COVID vaccination plan, with Lloyds Banking Group also saying that it is investing in an innovative air purification system that has been shown to kill the coronavirus and other microbes.

Lloyds share price is down 0.96% on the day.

Technical Outlook for Lloyds Share Price

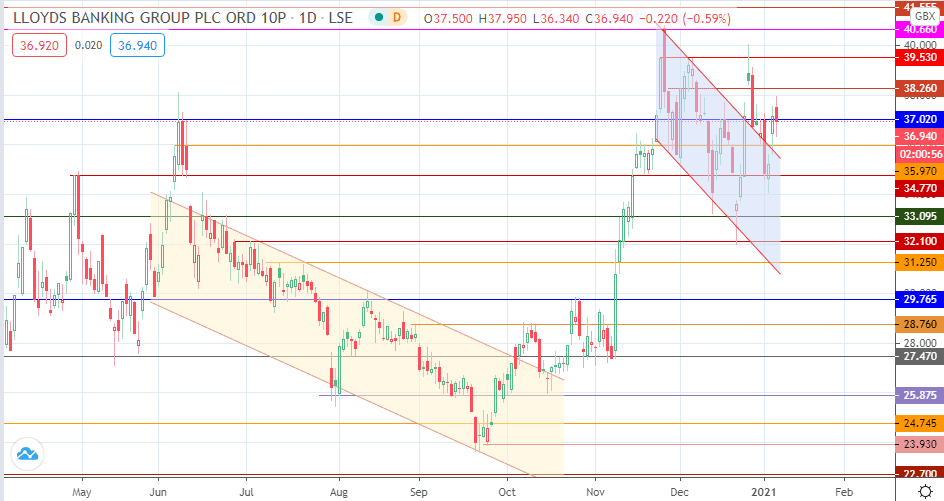

The dark cloud cover formed by the Wednesday and Thursday candles on the daily chart suggest further downside, but a bearish outside day candle is required to confirm this. This move targets 35.97 initially, followed by 34.77 and 33.095 as additional downside targets.

On the other hand, failure to confirm the break of 37.02 allows Lloyds share price a chance at recovery to 38.26 or 39.53, in that order.

Lloyds Share Price; Daily Chart