- Summary:

- The Lloyds share price has struggled in the past few days as concerns about the UK economy continues. The LLOY stock is trading at 44.35p

The Lloyds share price has struggled in the past few days as concerns about the UK economy continues. The LLOY stock is trading at 44.35p, ahead of the Bank of England (BOE) interest rate decision. This price is about 14% below the highest level this year. It is also the lowest it has been since September 23rd.

BOE interest rate decision

The LLOY share price has collapsed as the number of Covid-19 cases in the UK rises. On Wednesday, the UK confirmed more than 70k new cases, the highest it has been since the pandemic started. This means that the country’s economy could struggle to recover considering that a large part of the population has been vaccinated. Also, many people getting the virus have been already vaccinated.

As a result, there is a likelihood that the Bank of England (BOE) will sound a bit dovish when it concludes its interest rate meeting today. This is despite the fact that the UK has released strong economic numbers in the past few months. For example, on Wednesday, data by the Office of National Statistics (ONS) showed that the country’s inflation surged in November. Additional data showed that the country’s jobs numbers were strong in October.

Therefore, the Lloyds share price is falling since analysts expect that the BOE will sound a bit dovish when it meets. A dovish BOE is usually bearish for banks like Lloyds and NatWest.

Lloyds share price forecast

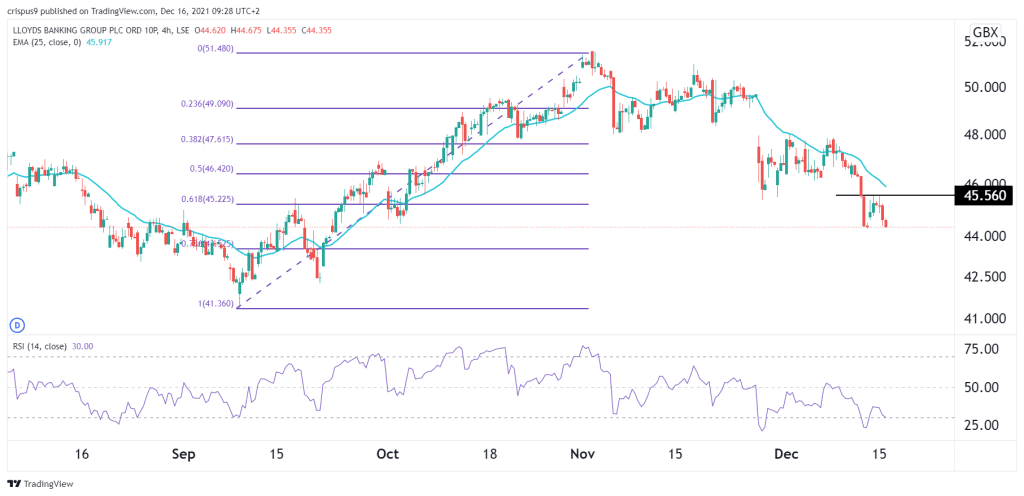

The four-hour chart shows that the LLOY share price has been in a major sell-off lately. The stock has managed to crash below the 61.8% Fibonacci retracement level. It also moved below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has been in a downward trend.

Therefore, the path of the least resistance for the stock is in the downside. This could see it decline to the key support level at 40p. On the flip side, a move above 45.60p will invalidate this view.