- Summary:

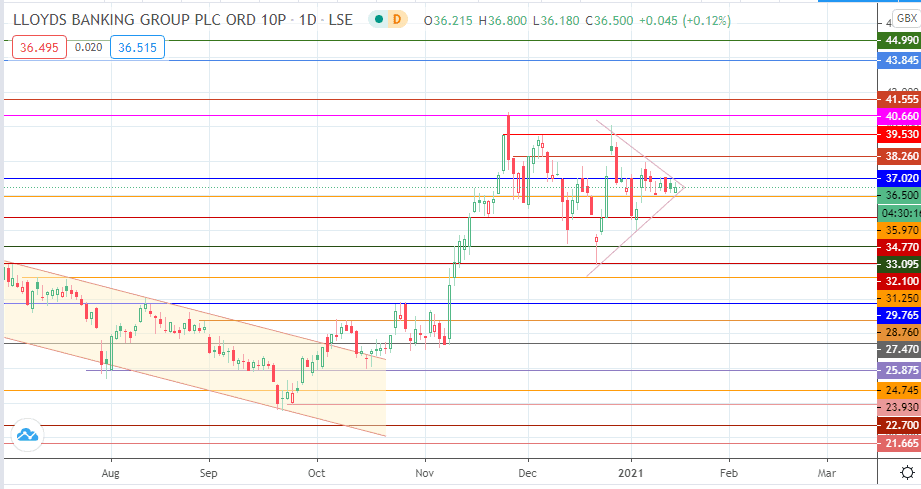

- Lloyds share price set for big move as price tightens within the triangle pattern on the daily chart, which is set for a breakout.

Lloyds share price dipped slightly today after the Financial Conduct Authority (FCA) issued a directive to UK lenders not to extend the repossession of properties to homes for another three months.

The no-forced repossession notices by the FCA were due to expire by the end of January after they first came into effect in March 2020 during the first lockdown. With the UK grappling with a severe coronavirus situation and another extended lockdown already in place, the FCA has decided to grant a no-repossession notice for another three months.

The thinking behind the notices is that ejecting people from repossessed homes during a lockdown would put such people in untold hardship and increase coronavirus community transmission risks.

Technical Levels to Watch

Lloyds’ share price looks set to explode out of the triangle on the daily chart. A break above the upper triangle border would also produce a breakout of 37.02, which opens the door towards 38.26 and possibly 39.53 in the first instance. The measured move would target 41.55 and would require bulls to take out these resistance levels and the 40.66 price level.

On the flip side, a break below the triangle must be accompanied by a break below 35.97 to bring in 34.77. Completion of the measured move to the downside targets 32.10. This move would also need to shatter the floor at 33.09 for the price projection point to be achieved.

Lloyds Daily Chart