- Summary:

- Lloyds share price has moved sideways in the past few days as investors focus on the UK economy and the company’s earnings.

Lloyds share price has moved sideways in the past few days as investors focus on the UK economy and the company’s earnings. LLOY shares rose to a high of 45.83p, which was slightly below this month’s high of 46.57p. The price is about 12.75% above the lowest level in July this year. This performance is in line with that of other banks like HSBC, Barclays, and Natwest

Lloyds stock price did relatively well after the company published the latest quarterly results. The firm, which is the biggest mortgage lender in the UK, said that its pre-tax profit rose to £2.04 billion in the second quarter from the £2.01 billion it made in the same period in 2021. The figure was also better than the median estimate of £1.6 billion.

According to the management, the company benefited from the rising interest rates. These hikes boosted revenue by about a tenth to £4.3 billion. The company also boosted its forward guidance for the year, helped by the soaring rates.

Therefore, the Lloyds share price will react to the latest UK consumer inflation data scheduled for Wednesday. Economists expect the data to show that the country’s inflation rose to 9.8% in July. A surge in inflation will lead to higher rates in the coming months. On Tuesday, data by the ONS showed that the country’s unemployment rate remained at 38.8%.

Lloyds share price forecast

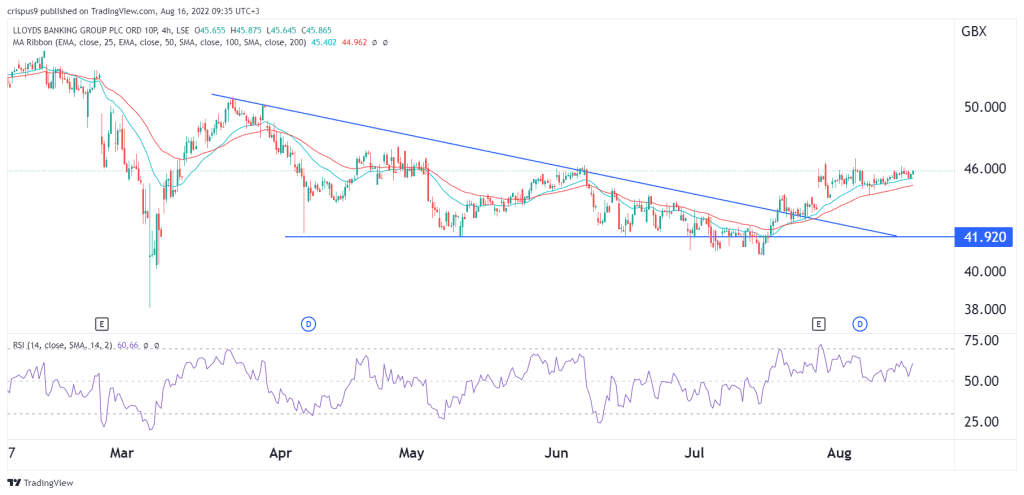

The four-hour chart shows that the LLOY stock price formed a descending triangle pattern that is shown in blue. In price action analysis, this pattern is usually a bearish sign. However, the stock made a strong recovery after the firm published strong results. This has seen it rise from 40p to over 46p. It has moved above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved above the neutral point.

It seems like Lloyds share price recovery has run out of steam. As such, the stock will likely remain in this range and then pull back in the coming days. If this happens, the next key support to watch will be at 44p. A move above the resistance at 46.40p will invalidate the bearish view.