- Summary:

- Lloyds share price is trading in a muted fashion after last week's strong close on expectations of a potential rate hike by the BoE.

The recent advance in the Lloyds share price continued on Monday, albeit mutedly, as the bank’s stock responded positively to the increasing bets of a Bank of England (BoE) rate hike in December.

Lloyds share price opened slightly higher on Monday, but lack of bullish momentum means it continues to trade around its opening price. This move followed Friday’s big move of 1.39%, prompted by comments from the BoE Governor Andrew Bailey on the need to preventing rising inflation from becoming embedded in the system. Rising interest rates is seen as bullish for bank stocks due to the demand that higher rates bring to fixed income instruments.

The Lloyds share price has overcome the headwinds posed by the CMA’s letter of 13 October, which accused the bank of several disclosure infractions. Lloyds shares fell 1.58% on the day, but Friday’s move ensured that the stock ended on a higher note last week.

Lloyds Share Price Outlook

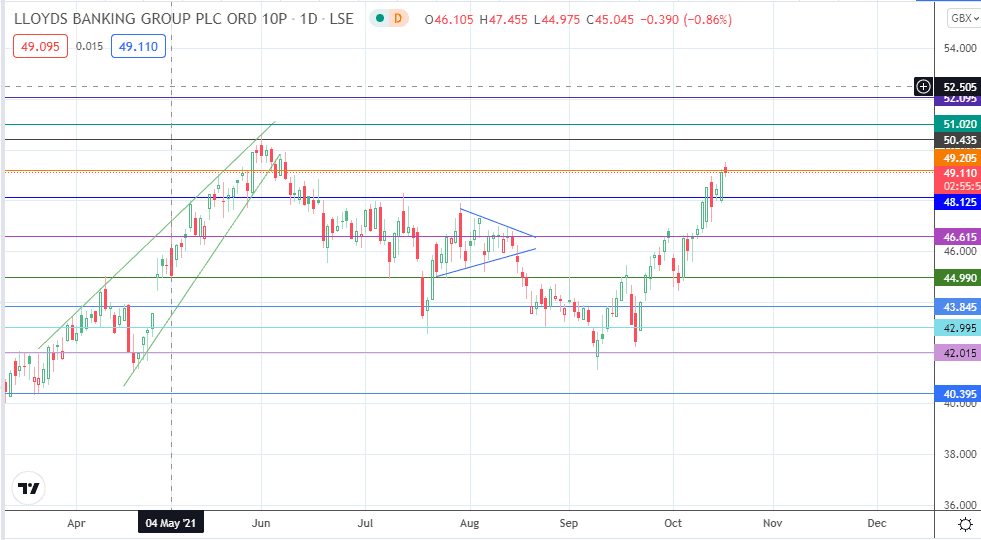

The intraday violation of the 49.205 price level has put that resistance at risk. A breakout continues the price advance and lines up 50.435 as the immediate upside target. A break of this level allows the Lloyds share price to hit new 2021 highs, with 51.02 and 52.095 (2 March 2020 high) as potential candidates.

On the other hand, rejection at 49.205 could initiate a pullback that targets 48.125 initially. A further corrective decline brings 46.615 and 44.990 into the picture as additional price targets to the south.

Lloyds Share Price: Daily Chart

Follow Eno on Twitter.