- Summary:

- The Lloyds share price has staged a strong recovery in the past few days as the initial impacts of the Russian invasion fades.

The Lloyds share price has staged a strong recovery in the past few days as the initial impacts of the Russian invasion fades. The LLOY stock is trading at 48.70p, which is about 28% above the lowest level since March 8. Its market cap has moved to about £34.27 billion.

Lloyds Bank has been in the spotlight in the past few weeks as investors focus on the bank’s business strategy. According to Reuters, the company is set to break its business units from three to five. First, it will split its retail banking division into two, with one focused on consumer lending and the other one focusing on savings. The company will also break its commercial business into two, one focused on small and the other focused on large businesses.

In addition, Lloyds’ share price is reacting to the company’s plans to invest £4 billion in the next five years. Most of these funds will go to the bank’s digitisation and boost its wealth management fees. The wealth management business is important since the CEO was the previous head of wealth management at HSBC.

Meanwhile, analysts are optimistic about the LLOY share price as the Bank of England (BOE) boosts its interest rates. For example, last week, analysts at Royal Bank of Canada reiterated its rating to outperform while JP Morgan set its target to 56p. Shore Capital and Deutsche Bank also have a bullish estimate.

Lloyds share price forecast

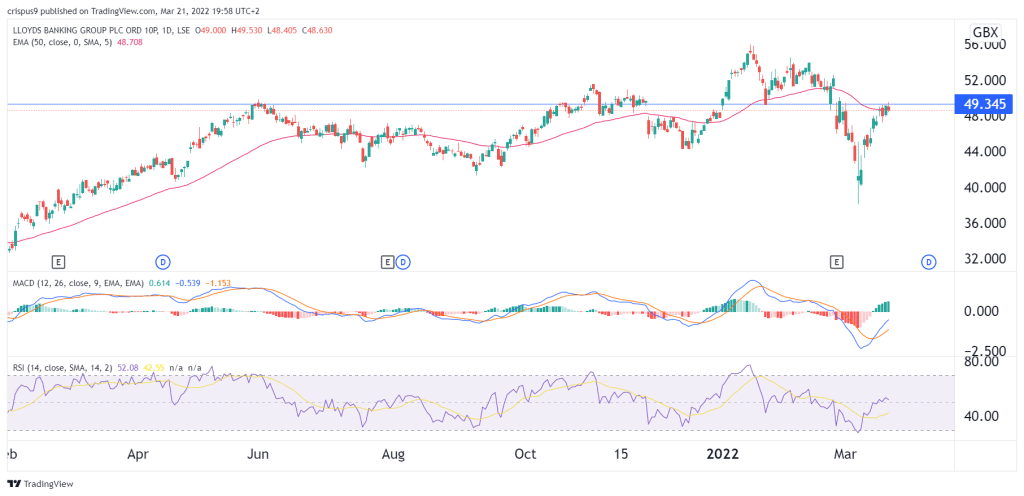

The LLOY stock price has been in a strong bullish trend as investors react to the BOE decision in the past few days. In addition, the stock is trading at the 50-day moving average while the MACD and the Relative Strength Index (RSI) have pointed upwards. All these are bullish signals. However, another bearish trend cannot be ruled out, considering that it has retested the resistance at about 49.34p. On the flip side, a move above 50p will invalidate the bearish view.