- Summary:

- The Lloyds share price has been in a consolidation phase as investors watch the happenings in the UK economy.

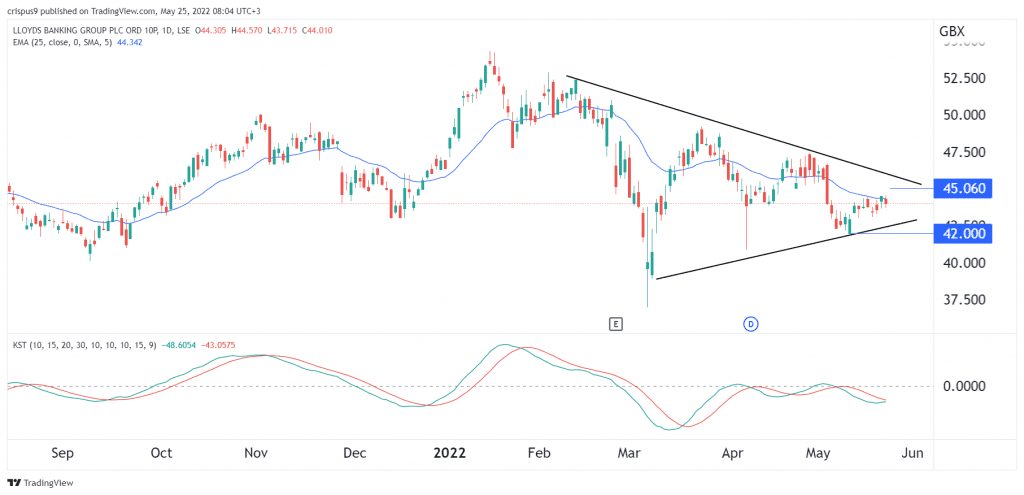

The Lloyds share price has been in a consolidation phase as investors watch the happenings in the UK economy. The stock has formed a symmetrical triangle and is currently trading at 44p, which is slightly above this month’s low of 42p. The stock is about 18% below the highest level this year, meaning that it has underperformed the FTSE 100 index.

Lloyds Bank is often seen as a barometer of the UK economy. It is an important bank because of its strong market share in key sectors like consumer lending, mortgages, and business lending. Also, like Natwest, Lloyds does not have a strong presence outside the UK. Therefore, the recent performance of the stock is a reflection that the UK economy is facing challenges.

For example, recent data by Rightmove showed that home price growth has been a bit slow in the past few months. While they remain at elevated levels, the growth that we saw in 2021 has clearly started fading. This happened as mortgage rates surged because of the actions by the Bank of England.

Therefore, while higher interest rates are positive for Lloyds and other banks, investors are worried about the overall growth of the economy. The company is also more exposed to the housing sector as it works towards becoming the biggest landlord in the UK.

Lloyds share price forecast

Turning to the daily chart, we see that the LLOY share price has been in a consolidation mode in the past few days. Along the way, the stock has formed a symmetrical triangle pattern that is shown in black. In price action analysis, this pattern usually signals that the asset will have a breakout in either direction. At the same time, the Know Sure Thing (KST) indicator has moved below the neutral level.

Therefore, there is a likelihood that the Lloyds stock price will remain in this tight range as the triangle pattern nears its confluence level. The key support and resistance level to watch will be at 42p and 45p.