- Summary:

- The Lloyds share price started the year well. On Wednesday, the LLOY stock jumped above the key resistance level

The Lloyds share price started the year well. On Wednesday, the LLOY stock jumped above the key resistance level at 50p and is currently a few points below its highest level in 2021. It has risen by 15% from its lowest level in December.

Lloyds Bank is in a transition process. The UK bank has a new Chief Executive and Chairman and is attempting to diversify its business. The company hopes to become a leading player in the fee business of wealth management. In 2021, the company acquired Embark, a wealth manager with billions in assets. It also announced plans to become the leading landlord in the UK by 2025.

The company’s goal is to reduce its exposure to interest income in an era when global interest rates are at a record low. Even with the current rate hikes by the Bank of England (BOE), rates will remain below their historic levels.

Analysts expect that Lloyds business will slow down this year although higher rates will provide a cushion. Besides, the housing market that grew rapidly in 2021 is expected to see some slowdown this year.

Lloyds share price forecast

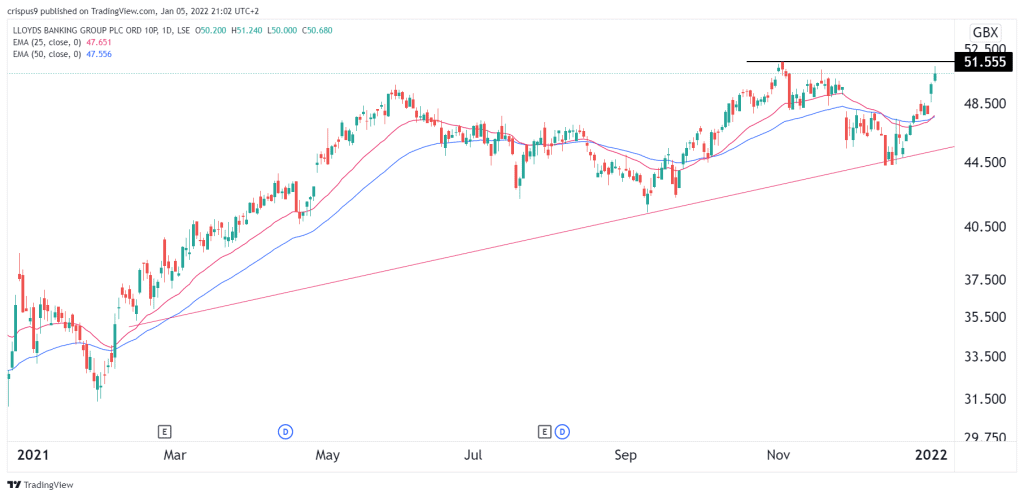

The daily chart shows that the Lloyds stock price has started the year well. It attempted to retest the highest level in 2021 this week. The stock remains above the 25-day and 50-day moving averages while oscillators have continued moving upwards.

At this point, it is easy to predict that the upward trend will continue. However, investors should be cautious since the stock seems to be forming a double-top pattern. In price action analysis, a double-top pattern is usually a bearish sign. The chin of this pattern is at around 44.25p.

Therefore, the key resistance level to watch will be the 2021 high of 51.55. A move above this level will mean that bulls have prevailed, which will open the possibility of rising to 55.