- What is the Lloyds share price forecast for 2022? We explain what to expect in the coming days as investors expect more growth.

The Lloyds (LLOY) share price forecast has done well in the past few months. The stock has jumped to a multi-year high of 56.10p, about 120% above the lowest level in 2020. The price is also the highest it has been since February 2020.

What is Lloyds Bank?

Lloyds is one of the biggest banks in the UK. Data compiled by SeekingAlpha shows that the bank has more than $1.18 trillion in assets, making it bigger than companies like NatWest and Standard Chartered.

Lloyds Bank Holdings operates in various industries in the UK. For example, it has a large retail lending business that offers personal and mortgage lending. It also has a small wealth management business through its Embark group. Further, Lloyds Bank has some of the biggest relationships with British companies.

Lloyds operates its business through several brands that cater to various clientele. For example, it owns the eponymous Lloyds Bank, which provides multiple banking solutions. It also owns MBNA, a company that offers credit cards in the UK and Scottish Widows, which provides insurance and investment solutions.

Other brands owned by Lloyds Bank are Halifax, Bank of Scotland, Schroders Personal Wealth, BlackHorse, and Lex Autoleasing, among others.

LLOY strong performance

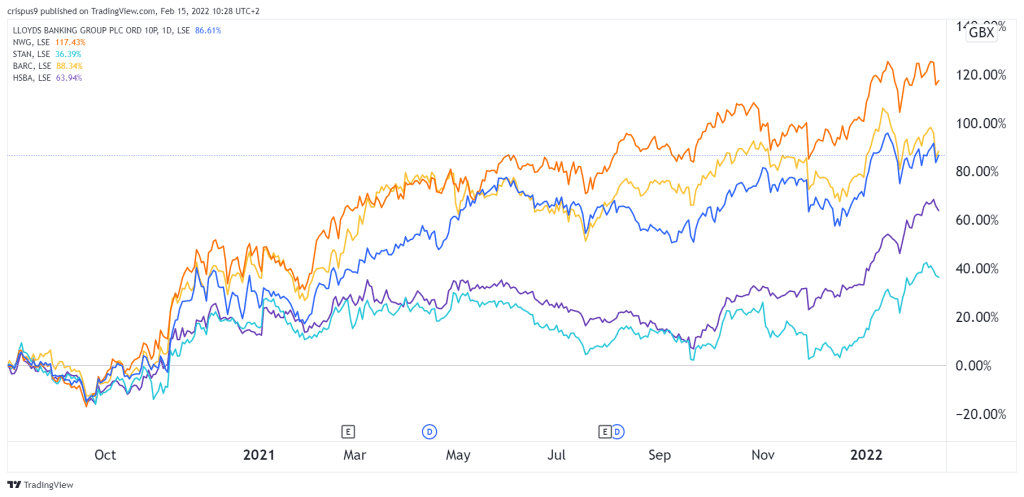

The Lloyds share price has performed relatively well in the past few years. As shown below, the stock has outperformed some of the biggest banks in the UK, like Standard Chartered and HSBC. It has also outperformed the biggest ETF that tracks banking stocks.

There are several reasons why the LLOY share price has done well in the past few years. First, the company has benefited from the ongoing recovery of the UK economy. Data published by the Office of National Statistics (ONS) showed that the country’s economy expanded by 7.5% in 2021.

That strong performance was better than analysts and the Bank of England (BOE) expected. Because Lloyds is mostly a national bank, analysts view it as a barometer of the UK economy. Unlike HSBC, Standard Chartered, and Barclays, it has minimal business in other countries.

There are other reasons why Lloyds stock price did well. For example, the company benefited from the overall strength of the UK home market. Data published by the ONS revealed that UK home prices surged in 2021 as demand rose.

Further, investors cheered the change of tone of the Bank of England (BOE) monetary policy. For the most part, in 2021, the BOE was optimistic about rate hikes. The bank managed to implement these hikes in December and February. As a result, there are hopes that the bank will deliver at least two hikes this year.

Lloyds Bank financial performance

Another main reason why the LLOY share price did well is that it delivered strong financial results. As you recall, in 2020, the company announced big losses due to provisions for bad debt. It had to do that because of the IFRS accounting standards.

Since the defaults were not as high as expected, the bank decided to shift some of its 2020 losses to 2021 profits. As a result, the firm delivered strong operating and net income in 2021. In the past three quarters, its net income was worth over $7 billion.

The company is expected to deliver quarterly solid results when it publishes them on February 24th. Analysts expect that the company’s results will show that it made total revenue of over $4 billion in Q4. The chart below shows the Lloyds Bank financial results.

Are Lloyds Bank shares paying a dividend?

Lloyds is one of the most popular stocks in the FTSE 100. One of the reasons retail and institutional investors love the stock is the income it delivers in the form of dividends.

Like all UK banks, Lloyds was forced to halt its dividend payouts to investors during the pandemic. At the time, the BOE was afraid that banks would go bankrupt again.

The Lloyds share price recovered in 2021 after the company started paying dividends. Lloyds now has a payout yield of 2.44% and a forward yield of 2.61%. It has a four-year yield of about 4.77%. Although its stock has outperformed, these numbers are better than other banks.

Lloyds recent developments and news

The Lloyds share price performed well because of the company’s announcements in 2021. First, the firm got new leaders. The former chairman, Antonio Horta-Osoria, moved to Credit Suisse. Charlie Nun became Lloyds Bank CEO in August 2021. He came from HSBC, where he was the head of wealth management.

Another important Lloyds Bank news was that the company announced plans to become the biggest landlord in the UK by 2030. Further, the bank acquired Embark in a 390 million pound deal.

Will Lloyds shares go up?

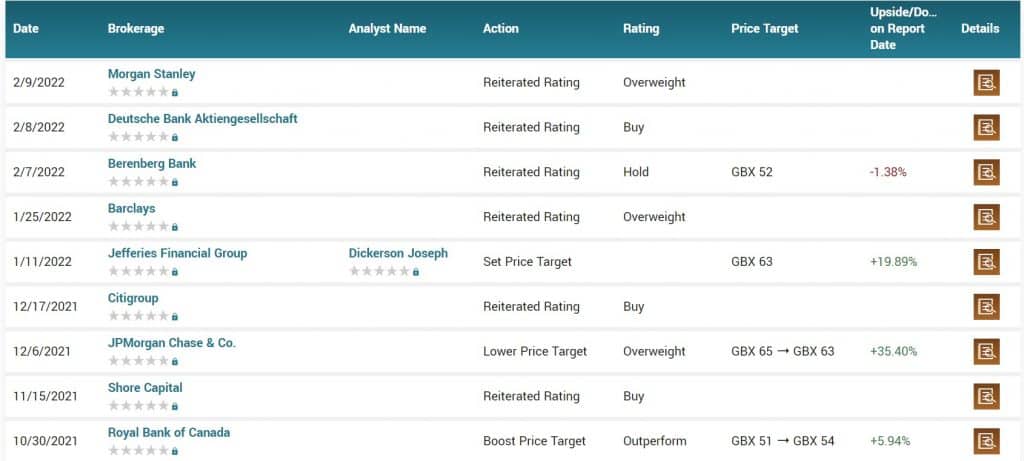

Analysts are generally optimistic about Lloyds share price. Data shows that the average estimate of the stock is 58p, which is a few points above where it is today. Moreover, as shown below, analysts from companies like Morgan Stanley, Deutsche Bank, Berenberg, and Barclays are optimistic about the shares.

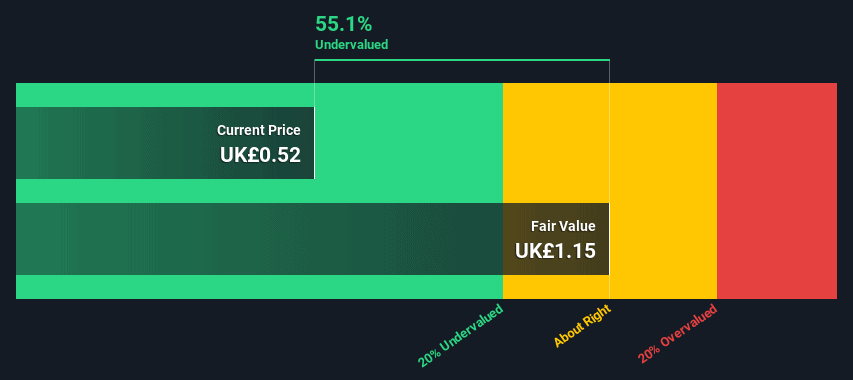

Another way to estimate whether the LLOY stock price will go up is to look at its future cash flows. You can do that using a discounted cash flow model. As shown below, the DCF valuation model estimates that the stock is undervalued by about 55%.

Lloyds share price forecast 2022

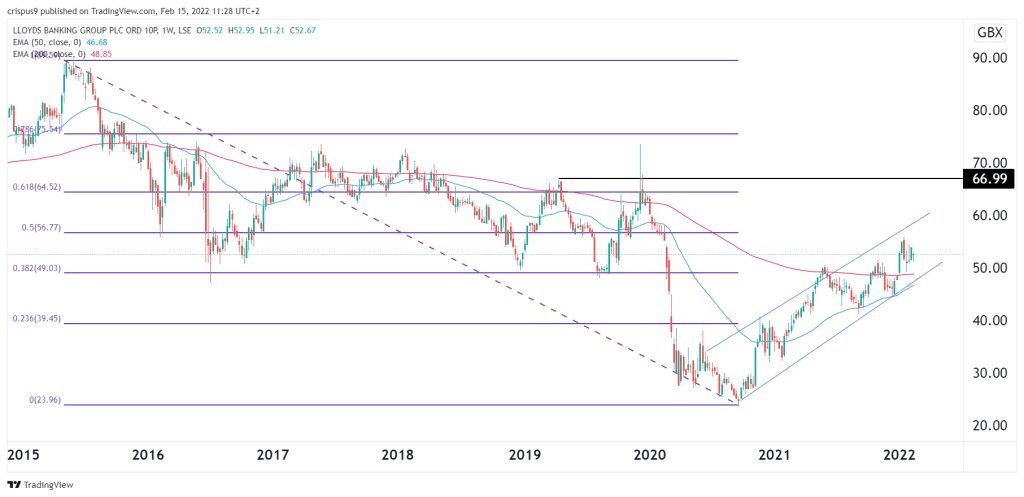

Turning to the weekly chart, we see Lloyds share price has been in a strong bullish trend in the past few months. Along the way, the stock has moved between the 38.2% and 50% Fibonacci retracement levels. It has also moved above the 25-week and 50-week moving averages.

The shares have also formed an ascending channel pattern shown in blue. However, a closer look shows that it is close to forming a golden cross pattern, where the 50 and 200 MAs make a crossover.

Therefore, the bullish trend will likely continue in 2022 as bulls target the next key resistance level at 65p. On the flip side, a drop below 45p will invalidate the bullish view.

Summary

Lloyds Bank has done well in the past few months as investors predict further tightening by the Bank of England. As a result, 2022 will likely be a good year for the company, although it faces multiple risks. For example, the slowing housing market will likely affect its earnings.