- Summary:

- The Lloyds share price is down for the third week in a row, but these dips could provide new buying opportunities.

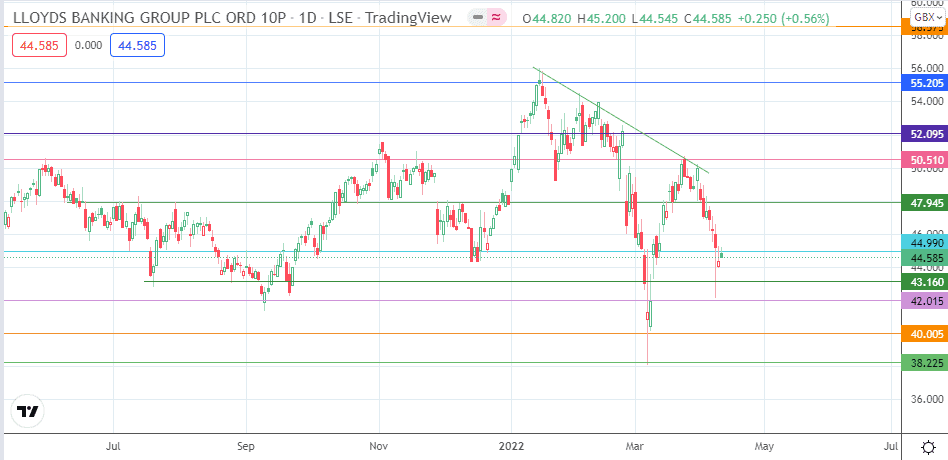

The Lloyds share price made a weak claim to the upside this Friday, closing with a 0,56% gain to end the day higher. However, this was not enough to end the week on a positive note as the stock closed just under 6% lower. This marks the third consecutive losing week for the stock, following a failure to advance beyond the 50.51 resistance level.

Upside momentum on the Lloyds share price activity was limited, as the 44.99 support proved too heavy for the bulls to protect. Thursday’s downside violation of the stock had put this support level in danger, and the inability of the bulls to force a penetration close above this level confirms the breakdown of that support, turning it into new resistance.

The stage looks set for the Lloyds share price to begin next week on a lower footing, with the 43.160 serving as the initial downside target. 44.99 remains the resistance to beat for traders seeking to push to new targets to the north. In the medium term, a hawkish Bank of England provides a strong tailwind for the Lloyds share price. Its investments into the UK real estate market in 2021 could prove to be a positive trigger as UK home prices are now at record highs. Any further selling could make the stock an attractive proposition in the future.

Lloyds Share Price Outlook

The bearish gap with which the stock opened Thursday’s session allowed for a downside violation of the 44.99 support level. This breakout attempt failed due to rejection at that barrier by the bears. A successive close below this level confirms the breakdown of this pivot, opening the door towards the 42.015 support. Below this level, additional pivots are seen at 40.00 (8 March low and psychological support level) and at 38.225, where the lows of 26 February 2021 and 7 March 2022 are seen.

On the flip side, a penetration close above the 44.99 price mark saves this support and creates a chance for the bulls to march on the 47.945 barrier. This barrier and the descending trendline are the limiting boundaries for the advance towards 50.51. This new target becomes available if the bulls take down the 47.945 resistance. 52.095 and 55.205 are additional price targets to the north that become available if the advance move continues.

Lloyds: Daily Chart