- Summary:

- Why is the Lloyds share price languishing as the UK interest rates rise? We explain what to expect now that the stock has crashed recently.

Banks were “supposed” to do well in a high-interest rate environment, but the opposite has happened. The SPDR Bank ETF (KBE) has dropped by 22% from its highest point this year, even after the Fed and Bank of England (BOE) have boosted rates. The same has happened for Lloyds (LLOY) share price, which has declined by 22% from its highest point this year.

Lloyds and other banks have joined the other stock sectors in the ongoing relentless sell-off. This decline has happened at a time when the Bank of England has delivered four 0.25% rate hikes and signalled that it will keep hiking later this year. In theory, this should be good for Lloyds and other banks with billions in assets. The rates have also provided a boost to the bank’s net interest income.

There are several reasons why Lloyds share price has declined in the past few weeks. First, analysts believe that the bank could be vulnerable if the property market shrinks. This is simply because the UK’s mortgage market tends to be highly short-term in nature, with typical mortgages being less than 10-years. This is notable since Lloyds holds mortgages worth billions.

At the same time, there are concerns about a recession in the UK. Last week, the BOE governor warned that the UK could sink into a recession in 2023. Therefore, with investors expecting a recession, there is a likelihood that they are also looking forward to lower rates in the future.

Lloyds share price forecast

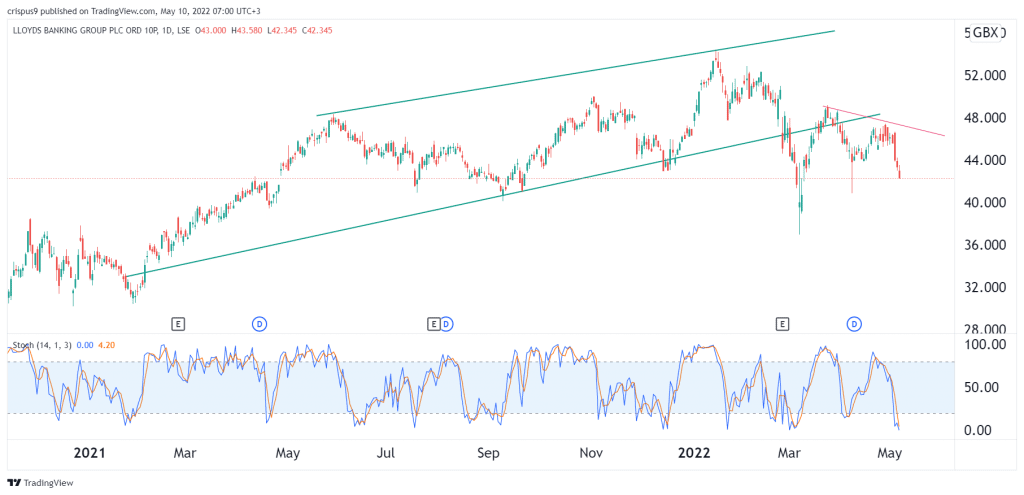

LLOY has been struggling in the past few months after it peaked at the year-to-date high of 54.25p. The stock has managed to move below the lower side of the ascending channel shown in green. At the same time, the stock has formed a sliding double-top pattern that is shown in red. The stochastic oscillator pattern has moved to the oversold level.

Therefore, the path of the least resistance for the Lloyds share price is lower, with the next key support being at 40p. A drop below this support will open the door for the stock to fall to the year-to-date low of 37.1p.