- Summary:

- The Legal & General share price is trading firmly in an ascending triangle pattern and could see strong gains.

The Legal & General share price is trading firmly in an ascending triangle pattern and could see strong gains with a breakout above that level.

Legal & General offers a strong dividend at a 6.5% dividend yield and Citigroup analysts were recently bullish about the company’s prospects.

“Management has consistently delivered double-digit EPS and strong DPS growth, yet this is not fully reflected in the shares,” Citi said.

As the business model matures, LGR reinsurance is close to self-funding and LGC, its alternative asset platform, is now a larger and growing part of the group. The next phase of the story is unlocking this value, said Citi, which includes demystifying LGC through progressive disclosure to more aggressive measures such as potentially selling minority stakes in LGC or LGR.

Citigroup has a 336p target from Citgroup.

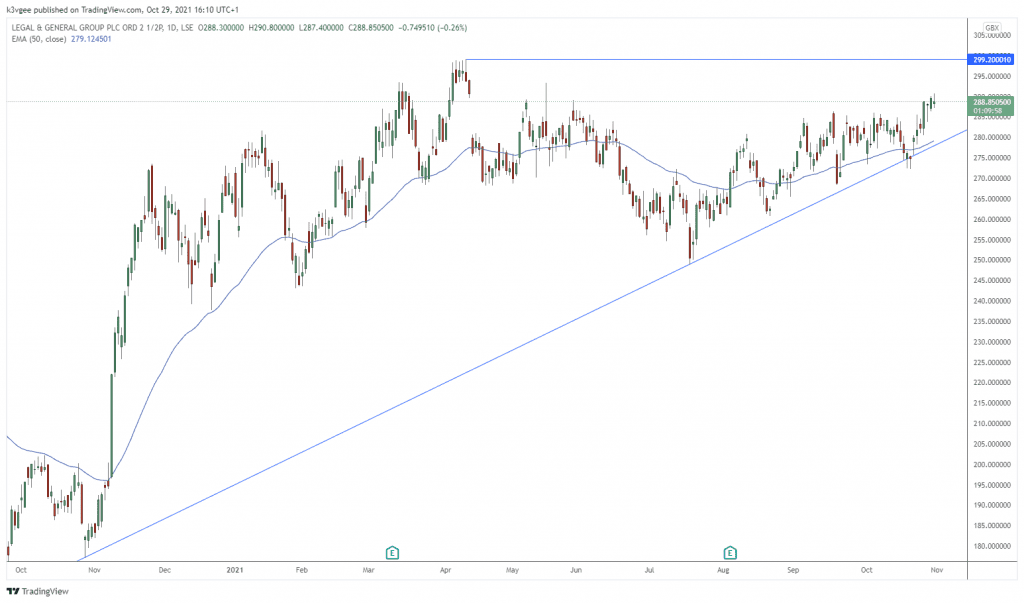

Legal & General Price Analysis

The price of LGEN shares are trading within an ascending triangle formation that dates back to a low set ahead of 2021. These patterns tend to be bullish in an uptrend, so the hopes for bullish investors would be a break above the previous highs at 299p. Support for the move is coming in at the triangle uptrend line which is also aligning with the 50 day moving average around the 280p price level.

LGEN Price Chart (Daily)