- The Knights share price collapsed on Tuesday after the company delivered weak forward guidance. The KGH is trading at 180p

On Tuesday, the Knight’s share price collapsed after the company delivered weak forward guidance. The KGH is trading at 180p, the lowest level since January 2019. This is substantially lower than the all-time high of 500p. It has collapsed by over 55% this year, meaning that it has underperformed the FTSE 100 and FTSE 250 indices. Its market cap has dropped to 150 million pounds.

Knights Group is a UK company that provides multiple legal services. The firm has over 1,000 fee earners that provide services to over 13,000 businesses in the country. The company has expertise in most industries like real estate, gambling, healthcare, aviation, and consumer among others. Some of the company’s customers are Alcidion, BGF, DuneIm, EasyJet, and Keyland Developments among others.

This week, the Knights share price declined sharply after issuing weak forward guidance. The company expects that its revenue will be 126 million pounds. This will be a better performance than the 103.2 million pounds generated in the same period in 2021. The management also expects to have a profit of 18.4 million, meaning that its profit rose by 23% while its profit fell by 2.2%. It attributed the weak performance to the impacts of the Omicron variant.

Knights share price forecast

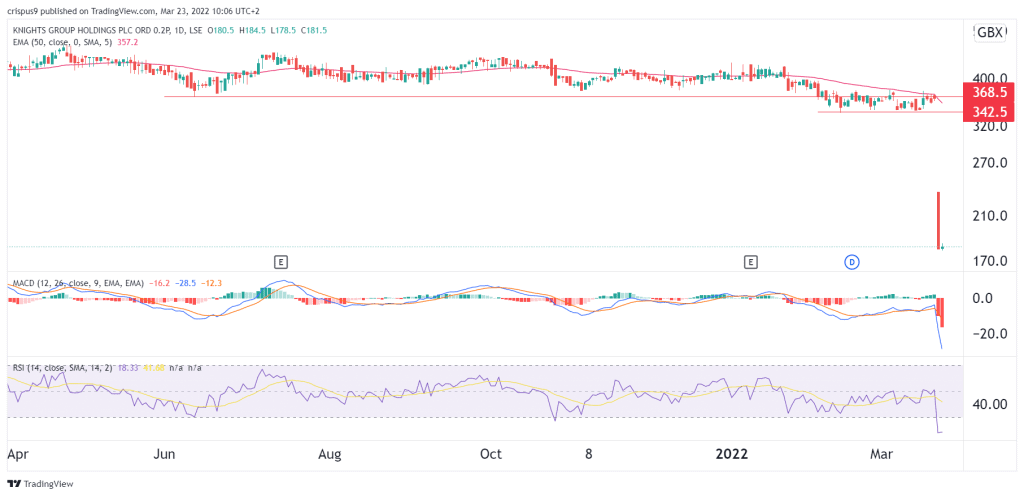

The daily chart shows that the KGH share price has been in a tight range in the past few months. First, the stock moved below the key support at 368p, the lowest level in June last year. Then, on Tuesday, the shares moved below the important support at 342p, the lowest level this year.

It moved below all moving averages while oscillators moved below the oversold level. Therefore, there is a likelihood that the Knights share price will remain being under pressure. If this happens, the next key level to watch will be at 150p.